THE COLD CHAIN SOLUTIONS NEWSLETTER

THE COLD FRONT, ISSUE 1

Frozen and Refrigerated Cold Chain Insights

Welcome to the first edition of The Cold Front, presented by RLS Logistics. We proudly offer nationwide cold storage warehousing, less than truckload shipping, truckload transportation and eCommerce fulfillment cold chain solutions. As cold chain experts in frozen and refrigerated logistics, we are focusing on these topics for our October 2020 issue: reefer spot rates, reefer market conditions, and dry and cold storage warehousing. This monthly summary highlights the pertinent cold chain market data in one concise location. As experts, we want to ensure that you have the data you need to make better decisions to fuel your growth. We hope you find this information useful! If you would like data for your specific market, click the link below.

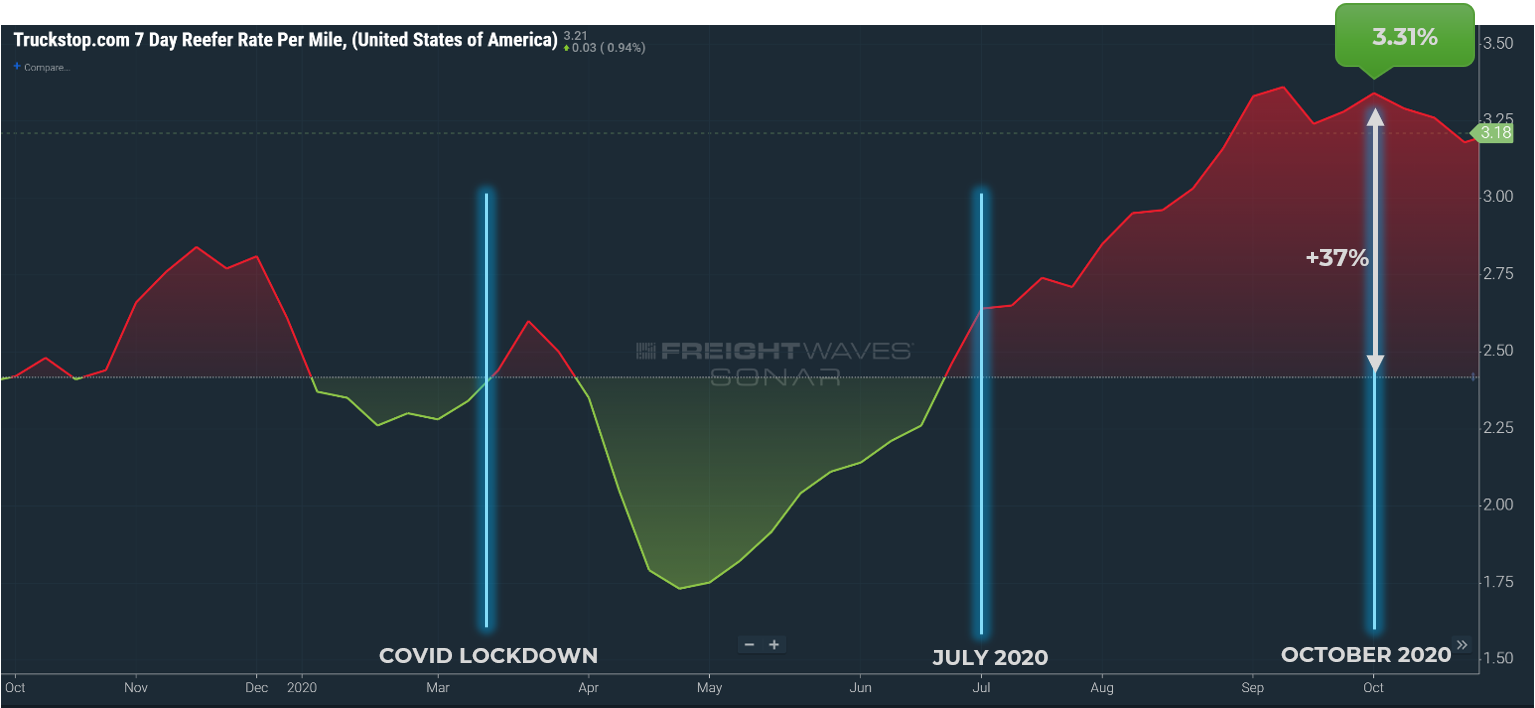

Reefer Spot Rates

Reefer spot rates have been on a steady climb since July. Compared to October 2019, the green shaded areas indicate relatively loose reefer capacity where shippers realize lower rates. The red shaded areas indicate tight capacity and significantly higher transportation rates. In late March, the lockdowns reduced the demand for trucking, and the results drove rates below the market baseline. As states began to open back up and many carriers parked their trucks, demand drove spot pricing up approximately 37%. We have seen a stabilization in spot rates in October. This could be an indicator that we have reached the peak.

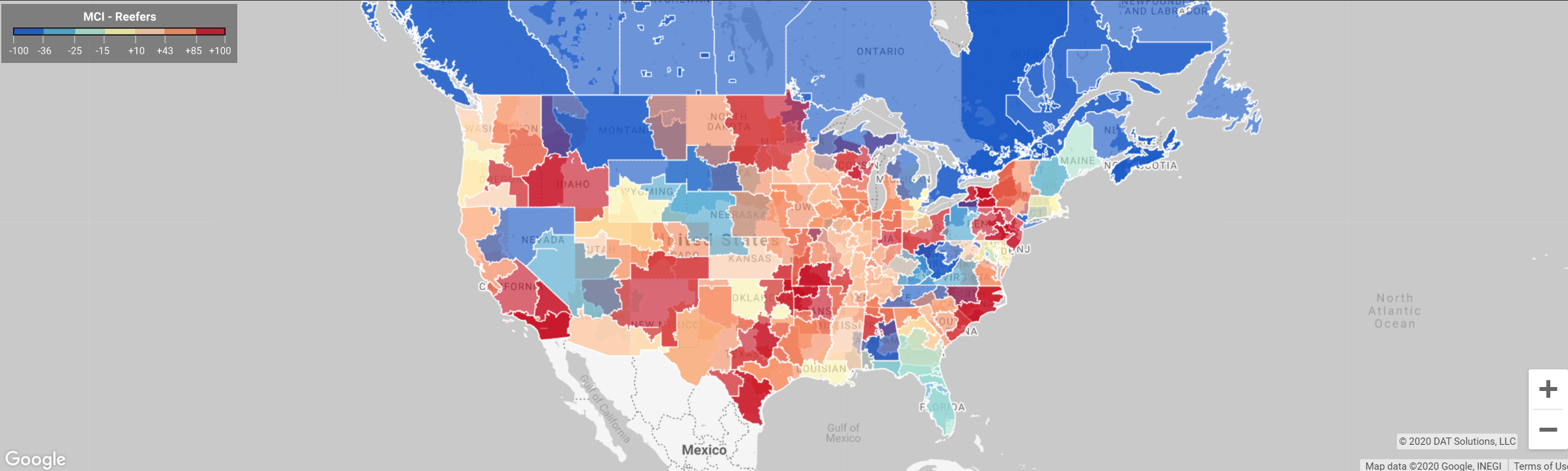

Reefer Market Conditions

The map below details reefer hot freight markets where capacity is tight and rates are higher. Areas in Orange to Red indicate a high load to truck ratio. Blue to Green areas indicates more loose capacity where there are more trucks than loads. Keep an eye on this map monthly as it is a good indicator of when crop harvesting affects trucking capacity.