THE COLD CHAIN SOLUTIONS NEWSLETTER

THE COLD FRONT, ISSUE 4

Frozen and Refrigerated Cold Chain Insights

Welcome to the fourth issue of The Cold Front, presented by RLS Logistics. We proudly offer nationwide cold storage warehousing, less than truckload shipping, truckload transportation and eCommerce fulfillment cold chain solutions. As cold chain experts in frozen and refrigerated logistics, we are focusing on these topics for our January 2021 issue: reefer spot rates, reefer outbound tender rejects, and a diesel outlook. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data you need to make better decisions to fuel your growth. We hope you find this information useful! If you would like data on your specific market, click the button below.

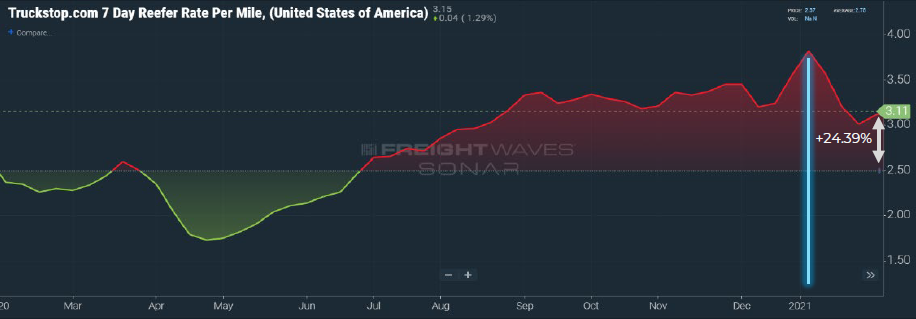

Reefer Spot Rates

Although the 7-day reefer rate per mile has declined since its peak in January 2021, rate pressure is still holding steady as capacity remains tight and the country prepares for reopening. Driver shortages, new equipment delays, port activity, and volume increases will continue to create upward pressure on rates for the foreseeable future. Rates are still 24.4% higher than where they were this time last year. Green shaded areas indicate relatively loose reefer capacity where shippers realize lower rates. The red shaded areas indicate tight capacity and substantially higher transportation rates.

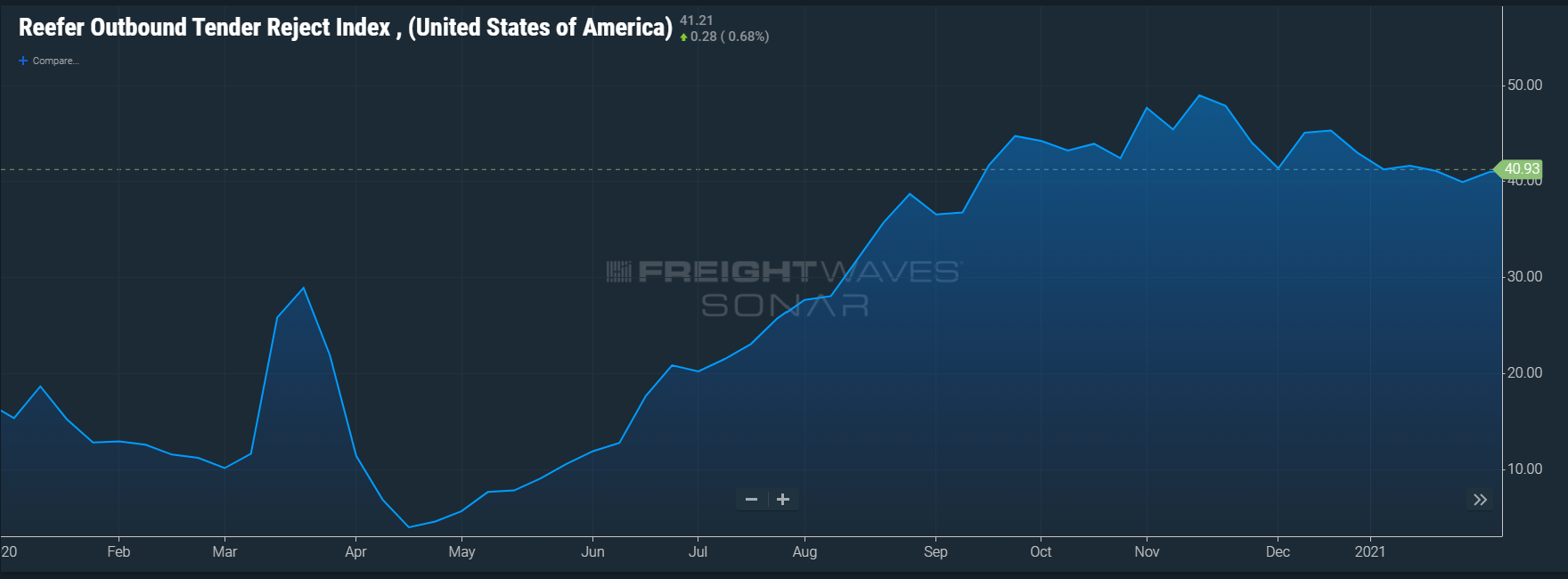

Reefer Outbound Tender Rejects

Reefer tender rejections may have also plateaued; however, they remain significantly higher regardless. The below graph depicts a robust spot market where trucks can demand higher rates than what they have in contracted rates. If we see this graph decline in the coming months, shippers in both markets should see some relief. Year over year, rejections are significantly high regardless of the plateau currently.

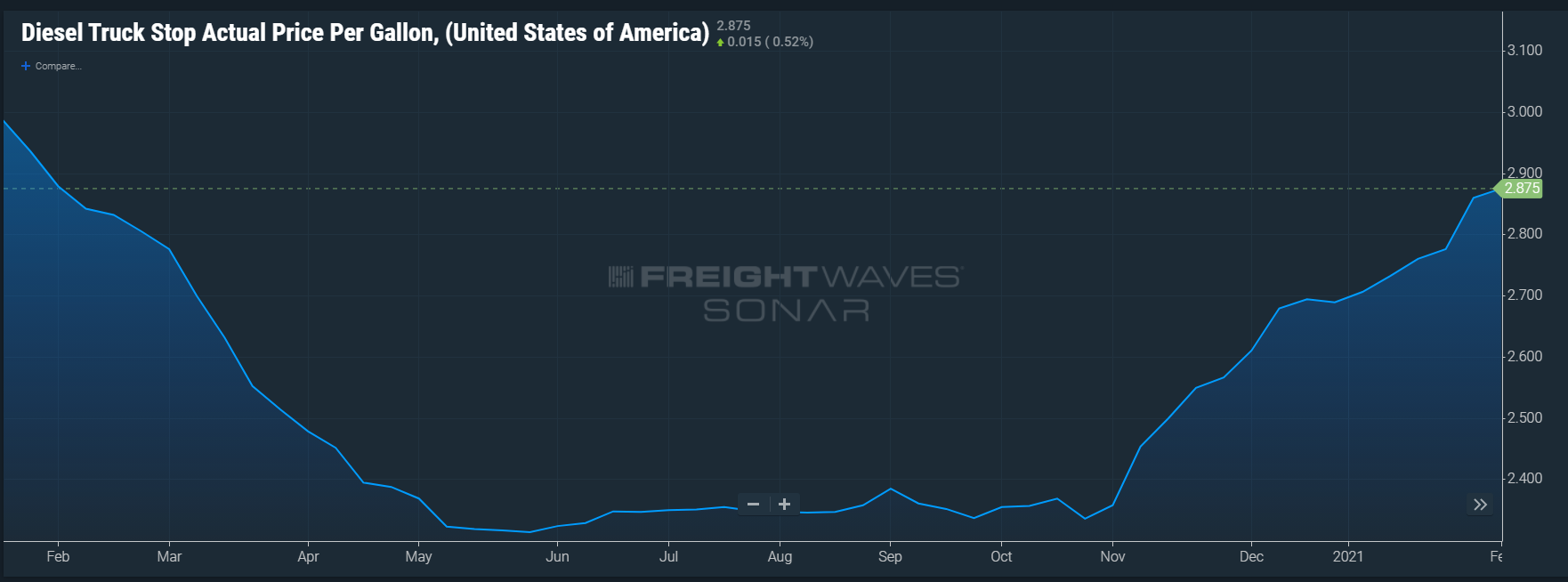

Diesel Outlook

Shippers and carriers may be feeling the sting of increased fuel surcharges, and costs as the price for diesel fuel continues a steady climb. Diesel fuel prices have increased for the past 15 weeks, since November 2, 2020. Diesel fuel prices are nearing pre-pandemic levels, and demand continues to be healthy. The current Department of Energy’s national average for diesel is $2.801, an increase of 21% from the beginning of November. Some experts believe that diesel prices could exceed $3.00 per gallon this summer, where others think it should level off at current levels. In a global economy laced with many “what if’s,” the price for diesel fuel should remain top of mind as we navigate through 2021.