Frozen and Refrigerated Cold Chain Insights

Happy New Year! 2020 was an eventful year that made “logistics” a household name. In this December 2020 issue, we will discuss reefer spot rates, class 8 truck sales, and an outlook on diesel. As restaurants closed nationwide and retailers struggled to keep shelves stocked, we witnessed a shift in consumer buying towards eCommerce. Foodservice inventories were not moving, retail demand increased, coupled with a surge in direct to consumer activity resulted in minimal warehouse capacity nationally. Many smaller carriers opted to park their trucks this summer, resulting in fewer trucks on the road, driving rates up and affecting transportation budgets for shippers. What can we expect this year? Many agree that once the COVID vaccine is available to everyone, we could see a renaissance and economic boom; there is plenty of pent up demand as we get “back to normal.” Welcome to the third issue of The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, less than truckload shipping, truckload transportation and eCommerce fulfillment cold chain solutions. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. As cold chain experts, we want to ensure that you have the data you need to make better decisions to fuel your growth. We hope you find this information useful! If you would like data on your specific market, click the button below.

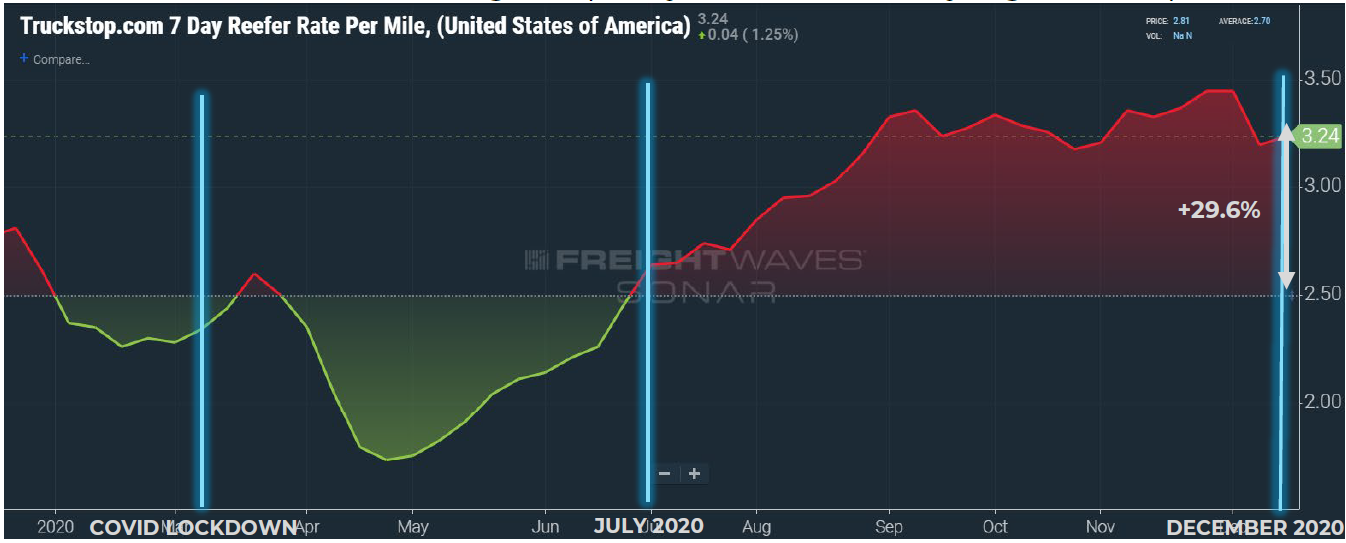

Reefer Spot Rates

Spot rates have plateaued since they began their climb back in July 2020. Barring any further lockdowns, this could be level for the next several months. Capacity relief could be on the way, which we will detail later in this issue. The Truckstop.com 7 day 2020 reefer rate per mile closed 29.6% higher than it was in January 2020. Shippers purchasing transportation services in the spot market undoubtedly struggled to make their budget. Shippers under contracts had to navigate increased tender rejections by their contracted providers but faired better than those in the spot market. Although rates may have stabilized, they are still significantly higher than where 2020 began. Green shaded areas indicate relatively loose reefer capacity where shippers realize lower rates. The red shaded areas indicate tight capacity and substantially higher transportation rates.

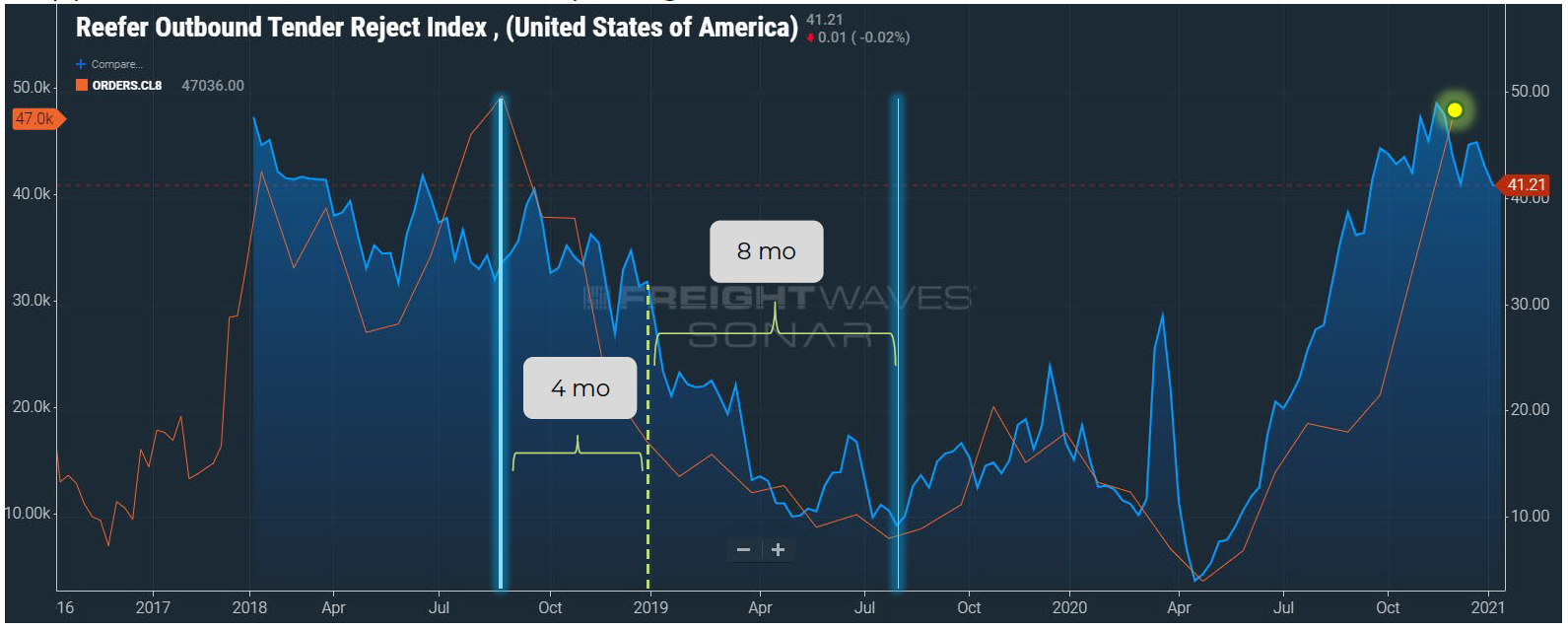

Class 8 Truck Sales

Class 8 truck orders are a leading indicator that more capacity will be entering the market. If history repeats itself, tender rejections decline over the following months as more capacity enters the market. The below graph details the impact that Class 8 truck orders had on the 2018-2019 tight capacity market. The orange line on the chart is Class 8 truck orders, and the blue mountain on the chart are tender rejections. As new truck orders increased in 2018 and reached their peak around September 2018, tender rejections began to decline after that peak. Tender rejections continued to decrease for the following eight months. Declining tender rejections shows a carrier’s shift from the spot market to more stable contract rates. We have seen Class 8 truck orders steadily climb over the past several months. We will continue to watch Class 8 truck orders to determine when they have peaked. After which, tender rejections should begin to decline, and shippers should see more favorable pricing.

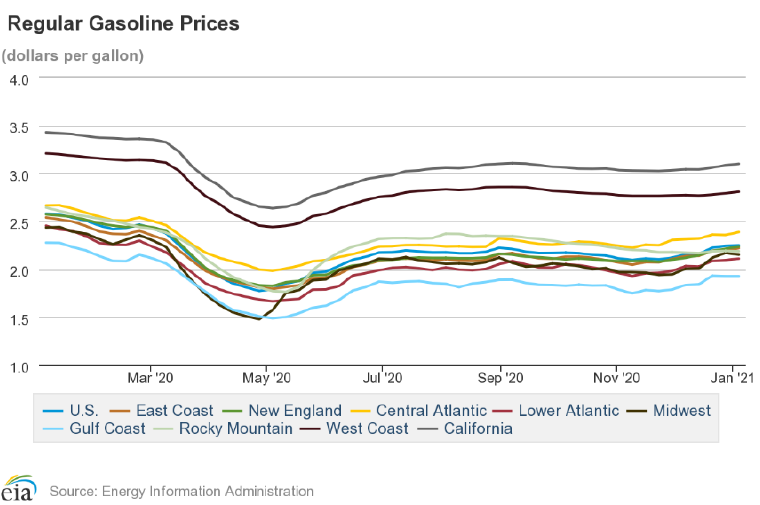

Diesel Outlook

Diesel fuel prices have risen for nine consecutive weeks, and Brent crude futures for February have increased. Even with a high volume of crude oil stocks globally and demand has not bounced back to pre-Covid levels, we anticipate higher diesel prices in 2021 than 2019 and 2020. As the United States kicks off the Covid vaccination campaign and hopes to lift pandemic restrictions increase, diesel could be in high demand in 2021. We will continue to monitor diesel fuel prices weekly.