Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage, and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our April 2025 issue: Tariffs’ effect on the Food Supply Chain, Tariffs, Diesel and Demand, and the state of Warehousing Occupancy. The Cold Front is a monthly summary highlighting pertinent cold chain storage market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

Tariffs: Effects On The Food Supply Chain?

The tariff conversation continues in this addition of The Cold Front. The current administration’s tariffs on imported goods, including a new baseline 10% tariff and higher duties on certain commodities from China, have added new dynamics to the U.S. food supply chain. Although the 10% baseline tariff has been paused until July 2025 (90 days), imports from China were not included and are subject to a 125%-145% tariff.

These changes present challenges and opportunities for those managing logistics, food distribution, and cold storage inventories. Historically, tariffs have raised costs across various imported food ingredients and packaging materials. Specialty products like cocoa, seafood, and certain imported produce could now carry higher price tags, impacting manufacturers and, eventually, retail pricing, unless favorable terms can be negotiated. Companies relying heavily on global supply chains for key ingredients must rethink sourcing strategies, optimize inventory positions, and seek cost mitigation solutions, or risk being left behind by those that do.

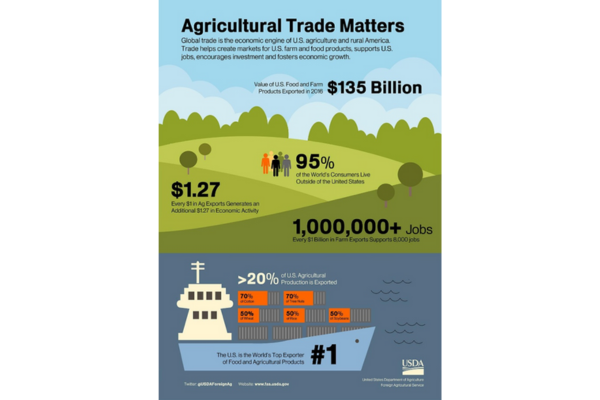

In response to the imposed tariffs, China has imposed a retaliatory tariff of 125% on American goods. In 2025, the USDA projects a $49 billion agricultural trade deficit. This shift in agricultural imports versus exports has been in the making over the past ten years. Since the 1960s and up until 2018, the U.S. has maintained a consistent agricultural trade surplus. The U.S. has been regarded as a top global leader in agriculture and a top producer of corn, soybeans, wheat, and meat & dairy products. However, in 2019, fueled by a compound annual growth rate of imports at 5.8%, while exports sank to 2.1%, the U.S. faced its first agricultural trade deficit. This was fueled by the American consumer’s year round demand and love of fresh fruits, produce, and imported foods.

However, it’s essential to recognize that every shift in the market creates new opportunities for those willing to adapt. In some sectors, these tariffs have helped level the playing field for U.S. producers competing against lower-cost imports. Domestic suppliers should benefit as buyers seek reliable, tariff-free alternatives closer to home. This shift creates opportunities for American farmers, manufacturers, and distributors to strengthen their presence in domestic and regional markets. Tariffs are only one part of the broader economic landscape we are navigating today. While introducing new challenges, they reinforce a critical truth: resilient, adaptable supply chains outperform reactive ones.

We will continue to monitor developments closely and share insights through future editions of The Cold Front. As always, RLS Logistics remains committed to delivering best-in-class cold storage, transportation, and fulfillment solutions and helping you thrive in any market conditions.

Tariffs, Diesel, and Demand: A Double-Edged Sword For Trucking

2025 continues to throw curve balls, sliders, and fast balls through the logistics industries, and many are fouling pitch after pitch just trying to stay alive and at the plate. The relationship between trade policy and energy markets has become increasingly pronounced. The recent imposition of tariffs is reshaping global trade dynamics and plays a significant role in the energy sector by introducing volatility, cascading effects in logistics and transportation organizations.

The global oil market has experienced fluctuations recently. Brent crude futures have declined to approximately $65.42 per barrel, while U.S. West Texas Intermediate (WTI) has fallen to around $61.65 per barrel. These price movements can be attributed to the trade war between the U.S. and China, which has reduced demand for futures and heightened fears of a global recession. Barclays has revised its 2025 Brent crude forecast downward by $4 to $70 per barrel, citing the anticipated oil surplus and the potential for further price declines if trade disputes persist.

In the U.S., oil producers have reported a 15% increase in drilling operations’ operating expenses due to the increased costs of steel, an essential component of drilling. The result is a forecasted reduction of oil production by 100,000 barrels per day. Reduced fuel prices are welcomed by the trucking industry, which has been plagued by significantly increased operational costs over the past several years, forcing many out of business. However, this one has a double edge. A reduction in oil prices as the demand for services heats up is one thing, but these lower costs can be attributed to reduced volume and demand, which is not suitable for an industry that has had to scratch and claw over the past few years.

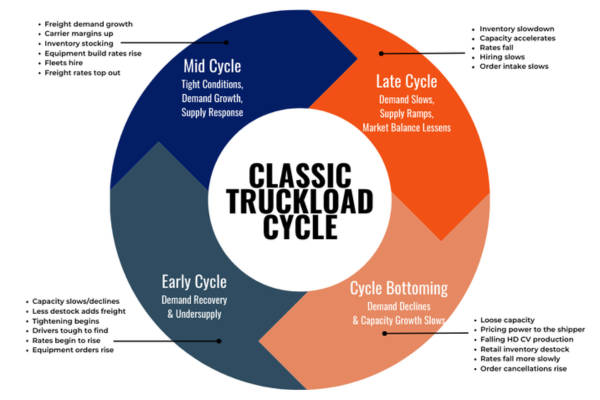

The freight recession, prevalent over the past few years, shows little sign of turning anytime soon. U.S. domestic producers and service providers are hopeful that tariffs can be negotiated, spurring an economic boom, increased volumes, and the end to the current freight recession. We will continue to monitor and report on internal and external data as we navigate this tricky geopolitical strategy. For now, like everyone else, we wait.

Warehousing Occupancy In Decline

Have you blinked yet? As we approach mid-2025, the domestic U.S. warehousing industry is not immune to strains on the global economy. The recent imposition of tariffs and the broader economic climate have introduced challenges and opportunities, leading to notable changes in warehouse occupancy rates and operational dynamics. The national industrial vacancy rate has increased significantly, reaching 8.5% in February 2025, an increase from the previous month and a doubling over the past two years.

This rise can be attributed to a few things. We have seen an influx of new warehouse projects significantly increasing supply and a more stabilized demand following the ecommerce boom in early 2020. The uncertainty surrounding recent tariff implementations has further compounded the issue, causing many to rethink signing that lease and delay until more economic certainty is on the horizon. While importers assess sourcing partnerships, they delay imports and inventory buildups, causing occupancy to drop. Additionally, the construction cost has skyrocketed, causing many new projects to be delayed or canceled altogether.

Keeping construction costs under control is critical to compete in markets where occupancy has fallen. The sentiment is prevalent for domestic U.S. cold storage companies but may not be as pronounced. Although we have witnessed pockets of capacity at RLS at some locations, facilities are essentially close to or at full economic capacity. Managing operational costs and right-sizing labor are critical during these times.

As trade policies evolve and economic conditions fluctuate, warehousing must remain agile, leveraging data-driven insights to inform logistics and real estate decisions. Collaboration between stakeholders—developers, occupiers, policymakers, and logistics providers—will be crucial in navigating this complex environment and capitalizing on emerging opportunities. We will continue to report on inventory health as we navigate a tricky global supply chain. We dodged a fastball with the recent construction and expansion project at our Delanco, NJ cold storage warehouse, scheduled to open this summer.