Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage, and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our October 2024 issue: East Coast Port Update, Signs of Relief For The Trucking Market, and Direct to Consumer Fulfillment. The Cold Front is a monthly summary highlighting pertinent cold chain storage market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

East Coast Port Update: It’s Not Over Yet

Earlier this month, the International Longshoreman Association went on a short strike before a tentative agreement on wage increases to parts of the ILA demands. Shippers and carriers are undoubtedly pleased that the strike lasted just three days and disruptions were minimal. However, there are remaining contract issues regarding automation where a shutdown could reemerge on January 15, 2025. The ILA wants ports to cease all projects where automation threatens union jobs.

Doing so would no doubt risk the US East Coast ports falling behind global rivals embracing new technologies that reduce headcounts and improve safety and efficiency. Many shippers worry the ILA will strike again in January and have already diverted inbound containers due in January to the West Coast. Some speculate the odds of another ILA walkout are 60% – 70% eminent and expect it to last a few weeks. It looks increasingly like the ILA is not finished with their demands, all while the ten largest US container ports are reporting an 11% year-over-year increase in inbound container volumes.

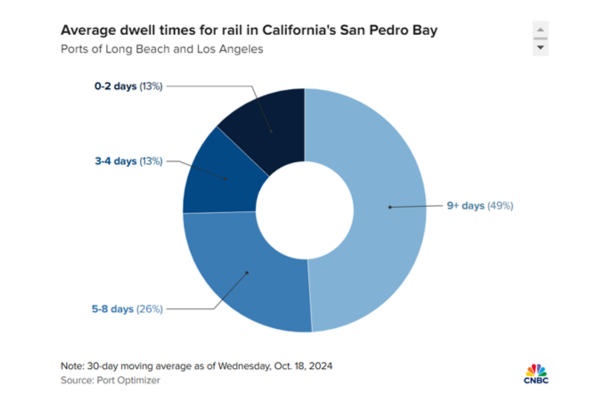

Some speculate this increase is due to pulling volume ahead of the October 1st strike deadline and potential tariff increases should former President Trump win the November election. Our internal data collaborates with these sentiments. West Coast ports are reporting increased dwell times due to the uptick in container volumes in September. All indications point to the continued increase in container volumes. According to the National Retail Federation, the winter holiday spending is expected to increase by 2.5% – 3.5% over 2023. The ILA and USMX will return to the bargaining table in November to work on the hard discussions on Port automation. We will keep a close eye on the talks as they progress through the rest of the year.

Trucking: Signs of Relief

According to the American Trucking Association’s reports, truck tonnage decreased 2.1% in September after a 1.7% increase in August, further muddying the clarity on when the current freight recession cycle could end. According to Bob Costello, ATA Chief Economist, and the below graph, the freight cycle this year has been “choppy.” However, the index shows an increase of 1.8% since the low earlier this year in January.

The RLS internal data shows a slow and steady increase in volume from the low in June; however, capacity is still relatively easy to procure. Freightwaves Sonar, another barometer tool used, corroborates ATA’s “choppy” analogy on the reefer freight volume this year, as shown in the graph below. It is impossible to predict when the market will change favorably to the carriers, but many believe it will be at the end of Q1 2025. Shippers should prepare and solidify relationships with their providers to minimize the impact of higher trucking costs for their 2025 budgets. Unfortunately, according to a recent article by a Supply & Demand Chain Executive, only 11% of US Manufacturers have a positive outlook for 2025, and nearly 49% expect a recession in 2025. There are far too many unknowns than known to predict a 2025 economy. With the election approaching, we will wait anxiously and report internal and external data as we compile it.

Direct to Consumer

Several new players in the final mile delivery sector of business-to-consumer have been taking market share and increasing costs for the two largest parcel providers in the country, who are shifting their focus to business-to-business volumes; given the new players in the arena, delivery performance increases. When service isn’t an issue, pricing is the focus, and there are more choices than ever when considering a regional final mile provider. With more final mile options and strong regional providers, shippers must focus on technology to improve performance and take advantage of different rate cards. Additionally, focusing on mode shifting yields good results. Many shippers are foregoing next-day air and air saver services for a slower ground transportation service. There are several strategies to consider when focusing on reducing parcel spending.

- Consider Ground

- Have multiple providers

- Understand zone skipping

- Right size packaging sizes

- Consolidate shipping days, reduce pick-ups

- Deliver to sorting centers

The good news for shippers is that Parcel shipping will continue to grow, and new technology and providers are leveling the playing field for shippers. Please contact us if you have any questions or comments on our D2C pick and pack capabilities.

Read Past Issues of The Cold Front: