Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage, and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our May 2024 issue: Diesel Prices, Ocean Container Rates, and Reefer Volumes during produce season. The Cold Front is a monthly summary highlighting pertinent cold chain storage market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

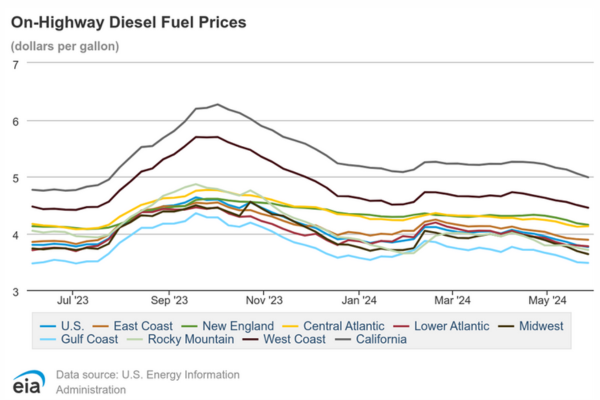

Diesel Pricing Deadline

As reported by the Department of Energy, the U.S. average price per gallon of diesel has seen seven weeks of decline and is 4.5% lower than this time last year. Shippers who are already clawing back inflated transportation expenditures from the peak demand in 2021 through Q1 2022 welcome the reduced cost. Oil futures fell as the stock market losses deepened this week, leaving fuel demand uncertain as the summer peak driving season kicks off. OPEC+ will meet this Sunday to review its production policy. It is expected to renew its production cuts, signaling a weak demand. Brent crude oil started the year at $87 per barrel, and the current cost is $83 per barrel. The US Energy Information Administration predicts Brent Crude to average around $91-$93 per barrel during the second half of 2024. That prediction could signal a shift in the freight market as demand heats up in the second half of the year. We will continue to monitor oil and diesel prices as we head into the summer months, leading to a traditionally busier Q4, although the past two Q4s were lackluster at best.

Ocean Container Rates Soaring

Ocean container spot rates have soared over the past month as capacity tightens just as peak shipping season starts. A recent CNBC article cites a perfect storm in global trade. The inbound container TEUs at the Port of Long Beach, one of the busiest ports in the US, have reported an increase of 25% since the beginning of the year and are significantly higher than pre-pandemic levels. The rise in container rates can be attributed to the higher demand coupled with the longer transit times due to the disturbance at the Red Sea. Also, geopolitical factors should not be ignored.

Recent tariffs have been imposed on imports from China, causing economic uncertainty and trade tensions. And let us not forget the potential labor negotiations on the US East Coast ports. Refer to the March edition of The Cold Front for more on that story. The shortage of containers at some Chinese ports has major retailers on edge as logistics providers sound the alarm on container shortages. According to the article, providers of ocean container freight have already announced a general rate increase beginning on June 1st. MSC, the world’s largest ocean freight company, has announced rates destined for the US West Coast will increase to $8,000 – $10,000 per 40’ container. Additionally, ‘blank sailings’ have increased in May and June. Blank sailings refer to the situation when an ocean carrier cancels a scheduled vessel sailing. This results in a temporary reduction in shipping capacity in that route. The reason for blank sailings could be related to capacity management or a strategic decision to influence freight rates. Drewry, a maritime research company, reported 17 blank sailings on the Transpacific route, which resulted in a severe decline in space availability. RLS will continue to monitor container and port activity as we continue through this busy period.

Produce Season and Reefer Volume

According to Analytics, the produce season kicked off to a slower start than usual. Volumes were 6% lower year over year in late April and early May. Typically, produce season can significantly influence freight volumes and rates due to the seasonality of agriculture production and the high demand for timely transportation. The peak produce season in the US is Spring (March-June): Strawberries, asparagus, and lettuce, particularly in California and Florida. Summer (June-September): Variety of fruits and vegetables like tomatoes, peaches, and melons, particularly in the Midwest, California, and the Southeast. Fall (September – November): Apples, pumpkins, and squash, primarily from the Northeast and Midwest. Volumes in these markets can spike by 30%, creating an imbalance of capacity and higher freight rates.

Traditionally, carriers may prioritize produce lanes over their contracted lanes, resulting in more tender rejections and elevating the spot market. Here are some tips for shippers to manage seasonal variations. Shippers should plan their transportation needs well before peak produce season, securing capacity early to avoid potential delays and paying higher rates. Diversify providers and work with multiple carriers to build strong relationships and ensure access to capacity during these times. Call upon RLS Freight Brokerage services to understand how having access to instant capacity can benefit your company. Be flexible with your schedules and offer service providers alternatives that other shippers may not have. This can propel you as a shipper of choice from your providers. These tips are crucial not only for produce season but also when the freight market turns, and capacity becomes tight.

Connect with the Cold Chain Experts this Spring

The RLS business development team will exhibit at various trade organization events this upcoming season. See one you are also attending and want to connect? Contact us to set up a meeting time!