Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage, and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our December 2023 issue: holiday retail sales, trucking capacity, and the supply chain resilience plan. The Cold Front is a monthly summary highlighting pertinent cold chain storage market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

Holiday Retail Sales- Including Food

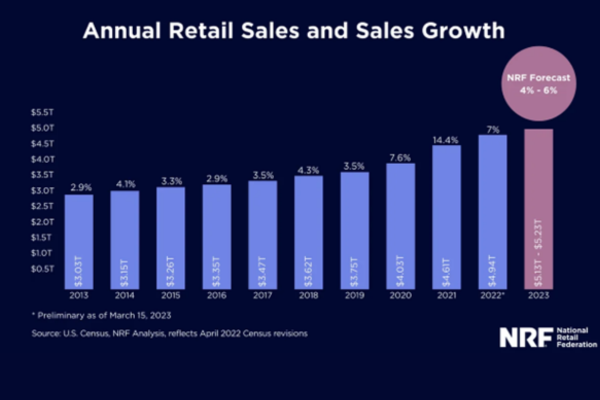

The National Retail Federation has reported strong retail sales as we kick off the 2023 holiday spending season. According to NRF, the total number of consumers shopping in the five days following Thanksgiving increased by about 3 million, surpassing expectations by 18 million. The increase signals that although post pandemic savings are dwindling, consumers are still spending despite challenging economic conditions, including substantial inflation. Both instore and online Black Friday shoppers increased from 2022, confirming the data, which expects an increase of 3-4% year over year holiday spending.

However, according to a recent article in Forbes, it is not all presents and bows as economic conditions look eerily like those witnessed in 2007, just before the Great Recession. In 2007, NRF projected a 4% rise in year over year retail sales but ended the Holiday Season with just a 3% increase. The NRF defines the Holiday Season from November 1 through December 31, so we still have some time to go. Back in 2007, holiday sales started strong, but due to market conditions, fell off at the tail end. Then, consumers weren’t faced with the inflationary pressures and significantly higher interest rates like we are witnessing today. So, although we are off to a strong start, the expert’s predictions for 2024 are not promising. The uncertainty of jobs, higher inflation, and geopolitical events are causing some concerns as we move into 2024. Food manufacturers have reported weaker sales but higher margins in 2023 as consumers continue to brand down and seek less expensive goods. Whispers of a recession have been discussed all year, and from what we are witnessing, they will continue into 2024.

Trucking Capacity

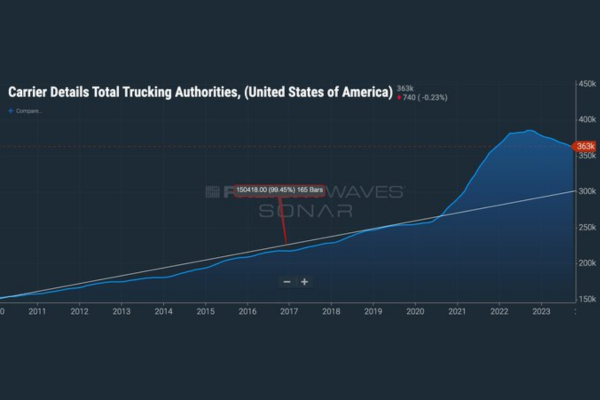

The freight market continues to see loose capacity and relatively flat demand. This imbalance of supply and demand results in a weak market where shippers continue to reap the benefits of reduced transportation costs. According to ACT Research, the net exits of fleets in the industry are worsening, and demand for new equipment is soft, resulting in a tighter freight market throughout 2024. Without a doubt, many of the experts underestimated how long trucking companies could weather the storm. We compare today’s freight recession to 2008, so why is it so different?

In a recent article by Freightwaves, the credit can be attributed to the growth of freight brokerages. According to the report, in 2008, freight brokers represented around 10% of the market. Today, freight brokerages represent over 20% of the market. That matters because freight brokers primarily utilize small carriers with 1-5 trucks. In the past, these small carriers had less access to loads and relied on shipper’s terms to pay their operating costs. Today, freight brokers control more of the market, and have programs, including same day pay, so small carriers have the lifeline to last longer in a down market. According to Freightwaves Sonar, unless revocations of authorities accelerate, the trucking market has 78 weeks to go before capacity is balanced to historical trends. So, unless we see a substantial increase in demand, which is unlikely based on current economic factors, current market conditions could prevail throughout 2024. There are a lot of factors that could accelerate market conditions, and we will be keeping a close eye on them; shippers should budget for a little increase in freight spend in 2024.

White House Council on Supply Chain Resilience Plan

The Biden administration has announced approximately thirty new action plans to strengthen critical supply chains strained by volatility in recent years. The Department of Energy, the USDA, and the Department of Defense announced investments in the supply chain to support a stronger, more resilient supply chain. The Department of Transportation’s Freight Logistics Optimization Works, or FLOW, is a public-private partnership that brings together US supply chain stakeholders to create a shared, common picture of supply chain networks and facilitate a more reliable flow of goods. The landmark initiative will bring public and private supply chains together to assess risk, analyze data, and improve the country’s supply chain. The plan addresses the domestic supply chain and strengthens the global supply chain through multilateral partnerships. You can read more about it here.