Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage, and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our July 2023 issue: diesel, freight volumes, and the RLS cold storage index. The Cold Front is a monthly summary highlighting pertinent cold chain storage market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

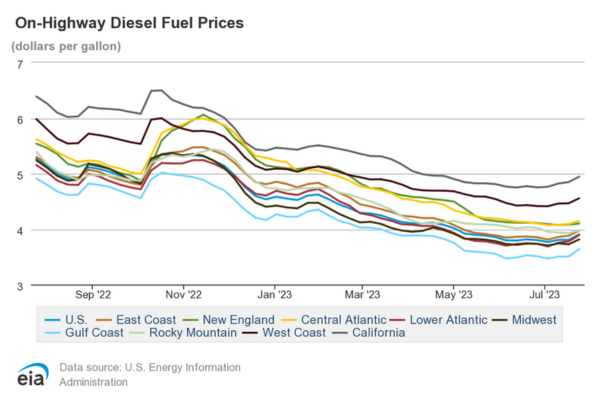

Diesel

Since the April 2023 issue of The Cold Front, we have discussed the reduction of oil output from OPEC and its effects. Over the past four months, we have been tracking the results of the reduced supply at the pump. Diesel fuel prices have increased +3% since June 1st, and demand for diesel could rise for an anticipated busier 3rd and 4th quarter. Diesel fuel is a trucking company’s most significant expense at around 20% of operating costs. Carriers blending fuel surcharges into the rates are at the most risk for the increase. According to a July 12th article from Land Line, the Energy Information Administration has forecasted higher demand and prices for crude oil, which should prop up diesel prices. We will continue to monitor energy and its effects on transportation spend.

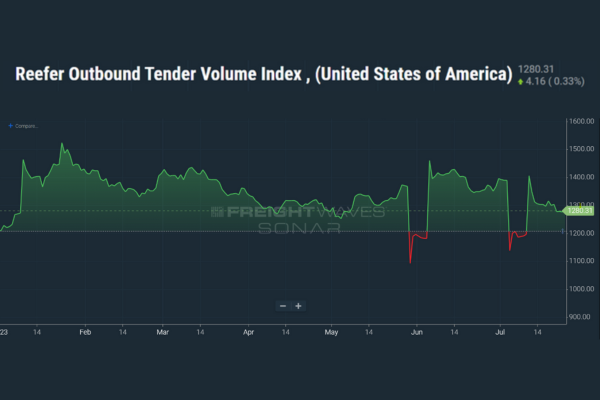

Freight Volumes

Have freight volumes finally hit bottom? We believe they have. The below chart details Reefer Outbound Tender Volumes as an index by FreightWaves, Sonar. Historically, volumes increased in August in previous years and continue to rise through the fourth quarter and Holiday Season. According to a July 14th article in FreightWaves, the Outbound Tender Volume Index, which measures all modes of national freight demand by shippers, rose almost 2% over the past two years.

Additionally, coming off the holiday, the Truckstop.com 7-day reefer rate per mile is 12% higher than its lowest point in May. Although it is hard to say that the market has begun to turn, we can say that the market should not continue the downward trend. FleetOwner says over 31,000 trucking companies have been closing up shop and leaving the industry. So, why hasn’t that impacted capacity? The reason is that about 79% of these losses were one truck owner-operators who moved back into company fleets. Even still, 2023 has been a challenging year for trucking, and if things do not improve soon, we will continue to see more carriers exit the industry.

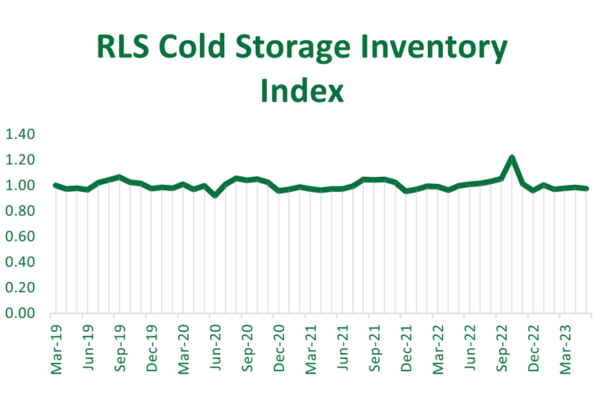

RLS Cold Storage Index

Below is the RLS Cold Storage Inventory Index reported by the National Agricultural Statistics Service, Agricultural Statistics Board, and the United States Department of Agriculture. This report is released monthly on refrigerated and frozen holdings in pounds from approximately 610 firms representing 76% of the total capacity. As you can see from the index, cold storage capacity is back to pre-pandemic levels of 2019. We must use caution; this does not mean more warehouse capacity in the market; the index is based on inventory holdings. Warehouse capacity was tight in 2019 and remains tight today. Across the RLS Logistics network, we report that all facilities are at or above capacity. RLS is adding 6,000 pallets to our Newfield, NJ, facility this fall. Although we have some commitments, we are still actively looking for frozen and refrigerated storage customers.