Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage and eCommerce fulfillment cold chain solutions. As cold chain experts in frozen and refrigerated logistics, we are focusing on these topics for our February 2023 issue: reefer tender volume, cold storage warehouse capacity, and port strategy between the east and west coast. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

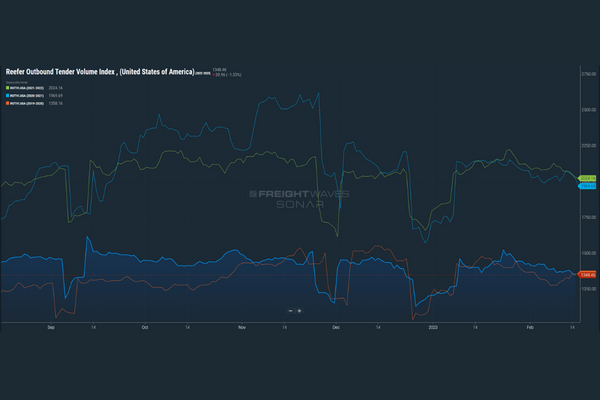

Reefer Tender Volume

Reefer outbound tender volume is a frequent subject in our issues of the Cold Front. In our October issue of the cold front, we looked at the past four years of seasonality. In the 2022 February issue, we were blown away by how closely the current transportation market mimics that of 2019. The chart below shows the similarities between the two years of freight volumes for the past six months. Understanding the past helps when planning the future. In 2019 we were coming off a strong 2018 freight market. In 2018, we experienced 12 loads for one truck, a strong economy, and trucking revenues increased by 14%. In 2019 volumes declined, the load to truck ratio decreased by 25%, the economy was cooling off as GDP fell, and trucking failures were the highest since the 2008 Great Recession. Sounds all too familiar. Volumes started to climb significantly in the second half of 2020. We don’t expect freight volumes to mimic the second half of 2020 to the second half of 2023; that volume can be attributed to the pandemic. But, there has been talk of a volume resurgence in the second half of 2023 as manufacturers and retailers replenish inventories. Will our past predict our future? We are not sure, but we will keep a close eye on inventories and volumes in the coming months.

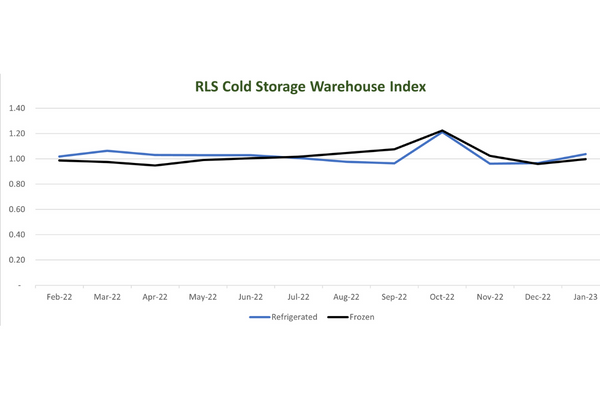

Cold Storage Warehouse Capacity

In our October issue of the Cold Front, we introduced the RLS Cold Storage Inventory Index as reported by the USDA cold storage capacity for end of month stocks of meat, dairy, poultry, fruits, nuts, and vegetables in public refrigerated warehouses. The updated chart below details increased inventories in October, most likely due to an expected busy holiday season. Unfortunately for retailers and manufacturers, the 2023 holiday season witnessed a slump in consumer spending driven by an economic slowdown, high inflation, rising interest rates, and chatter of a looming recession. Over the past few years, we have seen wide inventory fluctuations, creating a challenging time for planning labor. Although we see some relief in inventory swells and inventory spillover to other locations, customers are unwilling to reduce their capacity commitments. As long as inflation remains high, we anticipate elevated inventories and a willingness to minimum inventory requirements. The demand for cold storage continues to increase and is expected to continue for years, but new capacity is anticipated to fall well short of the market demand.

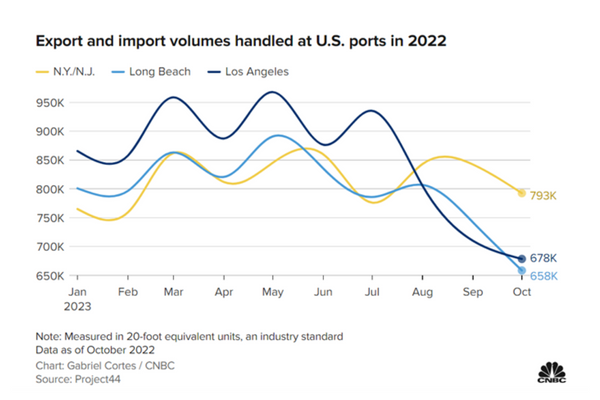

East Coast vs. West Coast-Port Strategy

A February 7, 2023 article published in the Wall Street Journal compared contract talks between East Coast and West Coast port workers. East Coast is playing offense and has already begun contract talks to replace the existing agreement set to expire in 2024. Conversely, on the West Coast, negotiations have stalled since last summer, and labor has been working without a contract. Given some of the pain importers felt over the past years while wary of labor strikes, many have shifted their debark port from West Coast to East Coast. In addition to labor, East Coast ports have been busy investing in their infrastructure, hellbent on retaining volumes diverted from the West Coast. Lastly, many companies have begun building an East Coast infrastructure, diluting the dependence on West Coast ports. East Coast ports are winning on domestic trade.

Connect with the Cold Chain Experts this Spring

The RLS business development team will exhibit at various trade organization events this upcoming season. See one you are also attending and want to connect? Contact us to set up a meeting time!