Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage and eCommerce fulfillment cold chain solutions. As cold chain experts in frozen and refrigerated logistics, we are focusing on these topics for our October 2022 issue: reefer outbound tender volume, retail sales for food and beverage, and cold storage warehouse capacity. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you would like data on your specific market, click the button below.

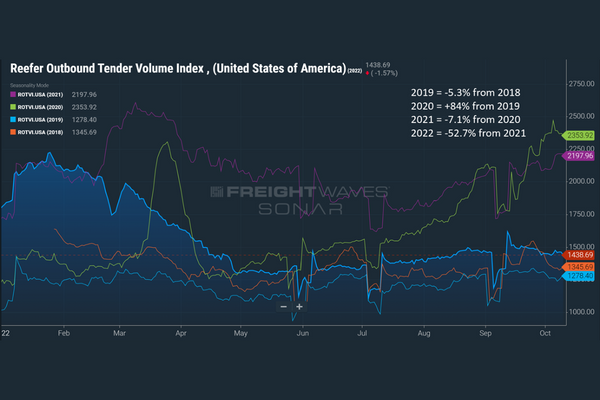

Reefer Outbound Tender Volume

The below chart shows the reefer outbound tender volume YTD and YOY. Notice the increase in outbound reefer volume from 2019 to 2020. 2019 was considered a soft transportation market compared to 2018. In 2019 load to truck ratios were reduced by 25%, signaling excess capacity in the market. Spot pricing decreased in 2019 by 30% off its peak in 2018. Trucking failures in 2019 topped those witnessed in the 2008 Great Recession. But look what happens to the volume in 2020.

In March 2020, volumes peaked when the global pandemic spurred increased buying at retail grocery stores. But, after Memorial Day in 2020, tender volumes began their impressive run and ended the year significantly higher than in 2019. The volume surge held strong in 2021. The result of this increased volume was considerably higher transportation purchase spend. This wasn’t the only factor, but it certainly contributed to the overall inflation of grocery prices over the past 18 months. Reefer outbound tender volume has dropped significantly in 2022. All eyes are on the economy and demand as we prepare for 2023 budgets.

Retail Sales for Food and Beverage Industry

The sales for food and beverage have increased due to foodservice opening up from pandemic restrictions lifting, inflation, and consumers stocking up on items out of concern for pricing rising even more. The chart below shows Retail Sales for Food and Beverage compared to Food Service Sales for the past five years. The increased dollar spent for both categories can be attributed to higher prices due to inflation and our love of dining out and supporting their favorite restaurants. The current state of foodservice looks strong, but just how long we will continue to support our local restaurants during an economic downturn will be the wild card.

According to recent retail insights from the American Frozen Food Institute (AFFI), AFFI also reports that 42% of shoppers are stockpiling items as a rising price concern. For manufacturers, this could shift the “just in time” mindset to a safety stock approach, causing additional demand for inventories.

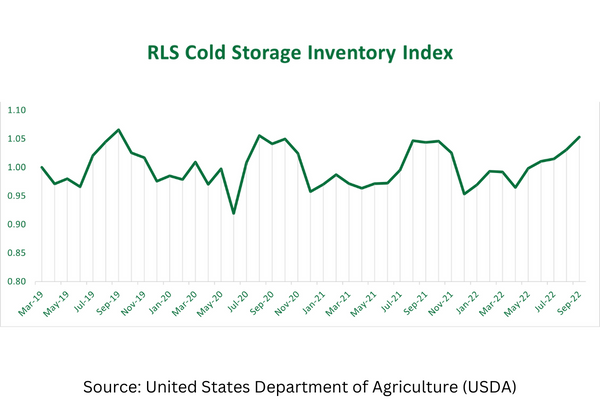

Cold Storage Warehouse Capacity Index

Cold storage warehousing capacity remains tight nationally. The below chart is released monthly by USDA and contains end-of-month stocks of meat, dairy products, poultry products, fruits, nuts, and vegetables in public refrigerated warehouses. The index has steadily increased since the beginning of the year and is confirmed by what we report monthly.

We are witnessing customer inventory levels rising, and turns decreasing, which hurts warehousing capacity. According to the latest data from WarehouseQuote, outbound orders to retailers are down by 33% YOY. Conversely, many manufacturers are increasing production output, exasperating the severity of cold storage warehousing capacity.