THE COLD CHAIN SOLUTIONS NEWSLETTER

THE COLD FRONT, ISSUE 11

Special Edition: “The Mother of All Reefer Capacity Shortage?”

Is your freight covered?

Traditionally, the 4th quarter has always been a busy time for companies supplying goods and services to the food supply chain. Thanksgiving, Super Bowl, and Christmas are the top three food consumption days, in that order. Therefore, food manufacturing ramps up production to support the increased demand for food, and warehouse inventories typically swell in anticipation of a strong holiday season. Additionally, transportation capacity tightens during this time of year as demand outpaces the supply of equipment. The result is a lack of available cold storage space and increased transportation costs.

We witness these typical cold supply chain patterns year over year. We have become so accustomed to these trends that it is almost automatic. The routine begins with our warehouse space planning by analyzing each customer’s surge in inventory year over year for Q4. Next, we hire additional labor to keep pace with the flow of goods moving through the cold supply chain. Finally, we analyze our carrier base to ensure that we have the needed capacity to move freight on trucks during this busy time of year. As cold chain experts, we love this time of year. It is dynamic and rewarding when we overcome the challenges we face.

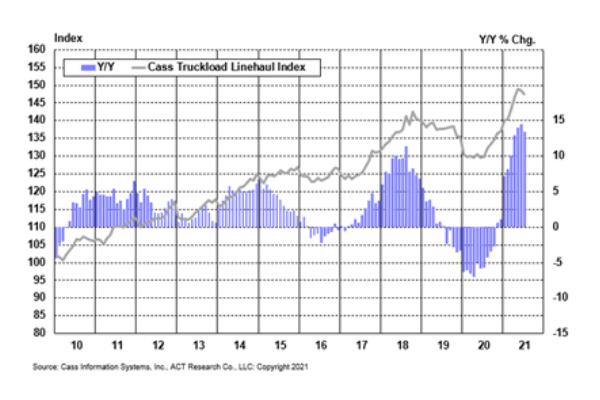

The Cass Truckload Linehaul Index recently reached an all time high of 150 points in June 2021. The index indicates increased upward pressure on freight rates. The contributing factors for this increase attribute to the equipment shortages of chassis and the congestion within the intermodal network and ports.

We have learned that this year has been different thus far. So, we need to prepare for inevitable disruptions, increased supply chain costs, and potential out of stocks on staple items. The Economist has called it a ‘Perfect Storm’; supply chain experts warn of imminent capacity shortages and surging pricing. So, brace yourself; this holiday season, we may witness The Mother of all trucking capacity shortage which could hang over the industry like a dark cloud for the foreseeable future. Below, we break it down to its simplest form, supply, and demand, and detail the costs implications for transportation and cold storage warehousing to the domestic cold supply chain.

Supply

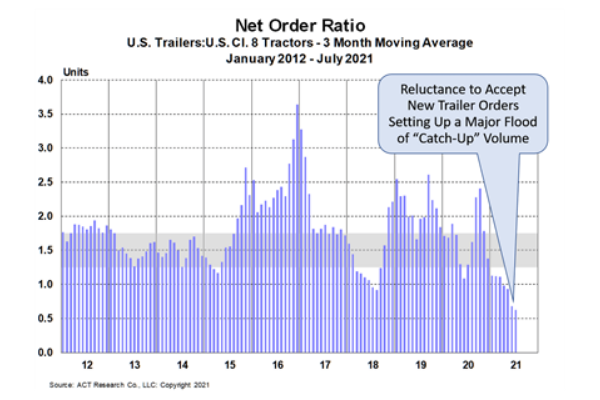

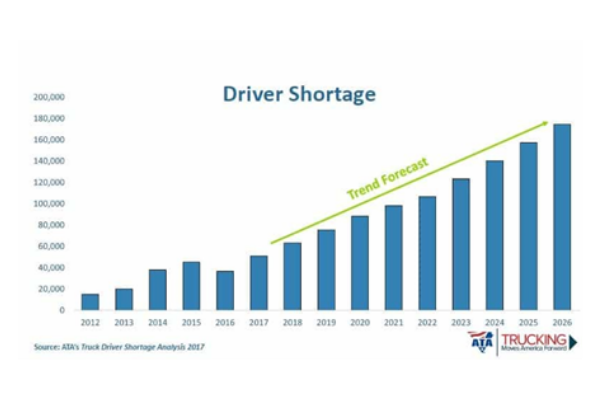

Simply put, there are not enough trucks for the amount of freight out there. Typically, trucking companies purchase more equipment when this occurs, and new independent operators enter the market. However, a global semiconductor chip shortage has not allowed that to happen. The production of chips has been hit hard by pandemic related shutdowns, geopolitical sanctions, as well as a fire in Japan’s largest chip production facility. Thus, we have seen steadily increasing truck orders, and significant delivery delays can be expected until Q3 2023. And keep in mind, if a company is lucky enough to expand its fleet, it has never been harder to put a driver in that seat.

Demand

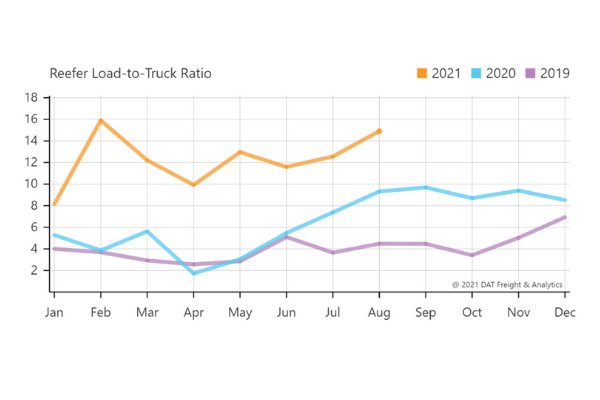

According to load board operator DAT, reefer load to truck ratios have increased +79% since January 2021. This significant increase can be attributed to a resurging economy, a shift in consumer buying habits, foodservice openings, and a new strategy towards increased inventories. As a result, consumer packaged goods sales rose +9.4% from last year and are expected to increase 8.5% of pre-pandemic levels. The jump in demand is forcing manufacturers and retailers to rethink inventory targets and inventory locale. This surge in demand has resulted in a favorable environment for carriers and warehousing companies. In short, carriers have more options when choosing who to call their customer and what price is needed to move the load.

Conclusion

Bottom line, we are in for a very challenging 4th quarter that may last well into 2022. As long as demand remains high, expect transportation rates to continue to rise. Freight volumes should remain robust. Much needed capacity may not have an impact until Q2 or Q3 of 2022. Inventory levels will remain elevated as well for the foreseeable future.