THE COLD CHAIN SOLUTIONS NEWSLETTER

THE COLD FRONT, ISSUE 10

Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, less than truckload shipping, truckload transportation and eCommerce fulfillment cold chain solutions. As cold chain experts in frozen and refrigerated logistics, we are focusing on these topics for our July 2021 issue: Producer Price Index, Consumer Price Index, and the state of the port volume and supply chain woes. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data you need to make better decisions to fuel your growth. We hope you find this information useful! If you would like data on your specific market, click the button below.

Producer Price Index and Consumer Price Index

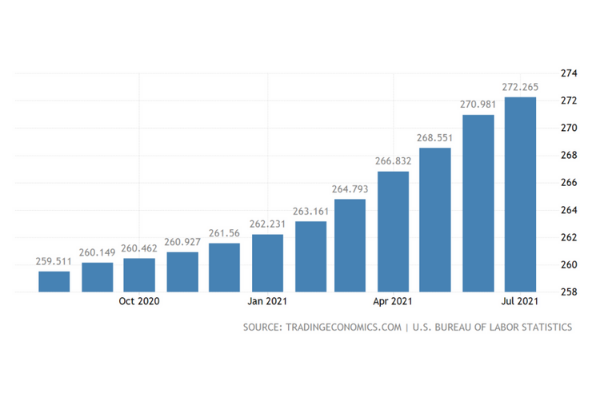

While recently purchasing goods and services, you may have noticed your dollar does not get you as much as it has in the past. Currently, the US is witnessing increasing inflation. The Consumer Price Index (CPI) and Producer Price Index (PPI) are two measures of inflation in our economy that directly apply to the daily cost of living in the US. CPI measures the total value of goods and services consumers have purchased over a set period, while PPI measures the input cost of producing consumer goods. Because the cost of goods sold is a good indicator of fluctuation in consumer prices, PPI can be used to predict inflation of consumer goods or CPI.

The U.S. Bureau of Labor Statistics shows an increase in CPI of 0.5% in July and 0.9% in June, and the YoY Consumer Price Index increased 5.4%. The food index rose .7% in July, as the grocery store and food away from home indexes increased over the past month. The Producer Price Index and Consumer Price Index have continued to rise since the beginning of 2021, indicating that inflation and the cost of living are rising.

So how does this relate to the supply chain? The CPI and PPI directly correlate to the cost of goods to make your products, the cost of transportation, labor, and the end price consumers pay to buy products. So it’s affecting all of us, which is why we will keep an eye on this topic moving into the holiday season.

U.S. Ports and Inbound Volume

Congestion at US west coast ports continues its grip on an already fragile US supply chain. Analysts say the port congestion will get worse before it improves. According to a June article published by The Loadstar, total US bound container shipments were up 47.1% from last year and imports from China have climbed 51.1% from last year. According to a July article published by Business Insider, there were 33 container ships at anchor waiting to dock off the coast of Los Angeles; nearly half of them are “mega container ships” with a carrying capacity of 10,000 TEUs each. Ships of this size take longer to unload, require more warehouse space and more trucks to move the cargo. The chart to the right shows the inbound ocean TEU volume index. The white dotted line is the number of confirmed bookings scheduled to be loaded at foreign ports destined to the United States. As we head into fall with schools reopening, strong retail sales, and families preparing for the holidays, this could be a very challenging 4th quarter for shippers.

Supply Chain Woes

It seems supply chain issues are here to stay for the remainder of 2021. What is new to the mix in this month’s issue is the strategy some conglomerates are taking to get ahead of the holiday volumes while leaving the rest scrambling. Recently, Home Depot and Walmart announced that they are chartering their own vessels to ensure it has enough freight capacity to meet the demands for peak season. The move to limit out of stock situations. Supply chain constraints offer large companies a significant advantage over smaller competitors who lack the resources to compete. Approaches like this will add to the challenging holiday season we have ahead.

Furthermore, we continue to watch the supply chain disruptions related to supply shortages, semiconductor chips being a huge one we saw in the first half of 2021. The demand for freight is at record levels, while the future of Class 8 truck production is foggy. Intel’s CEO, Pat Gelsinger, predicts the chip shortage disruptions will linger into 2023 until we see it getting back to “normal.” We don’t have a crystal ball to look into to see what will come over the next few months, but this sturdy ship is ready to weather the storm ahead.