THE COLD CHAIN SOLUTIONS NEWSLETTER

THE COLD FRONT, ISSUE 9

Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, less than truckload shipping, truckload transportation and eCommerce fulfillment cold chain solutions. As cold chain experts in frozen and refrigerated logistics, we are focusing on these topics for our June 2021 issue: class 8 truck orders, cold storage warehouse capacity, and transportation volume and rates. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data you need to make better decisions to fuel your growth. We hope you find this information useful! If you would like data on your specific market, click the button below.

Class 8 Truck Orders

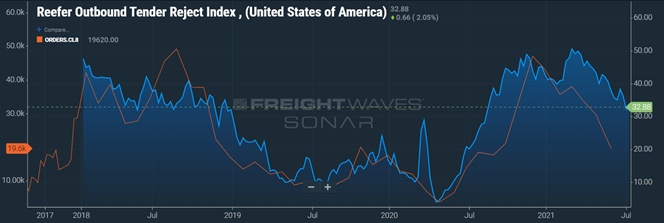

In our March issue of the cold chain solutions newsletter, The Cold Front, we discussed how new truck orders signaled a reduction in tender rejections and a softening freight market over time. Although we have seen tender rejects decline since the end of February, providing some relief for shippers, freight volumes remain historically high, keeping upward pressure on rates.

While the chart does not have June’s Class 8 truck orders calculated yet, ACT research shows that orders in June were 11% higher than May, with about 26,700 units being ordered. Additionally, June’s orders are 71% higher year over year. Supply chain issues continue to concern truck manufacturing, and orders placed earlier in 2021 will undoubtedly roll over into 2022’s production. The backlog is predicted to last well into 2022 as manufacturers opened 2022 order books early. There is no doubt that this market will take as many tractors and trailers that can be produced given current freight volumes. The question remains, when will the equipment become available, and will the additional equipment cool a hot freight market?

Cold Storage Warehouse Capacity

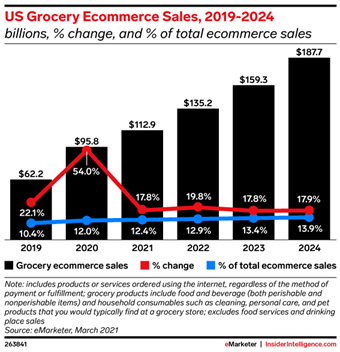

Online grocery sales grew 54% in 2020 and are not expected to slow down anytime soon. First time grocery buyers sales spurred by the pandemic will embrace the digital experience and continue purchasing grocery items online. By 2022 it is expected that more than half (51.3%) of the population will be digital grocery buyers. According to Insider Intelligence, online grocery sales will surpass $100 billion in 2021 and makeup 12.4% of total US eCommerce sales. This increased demand in online order fulfillment creates a shift in the need for cold storage warehouse capabilities. CBRE anticipates an increased need for industrial cold storage space of about 10% to support online grocery fulfillment. In addition, retailers are investing in improving customer trust in online cold chain product integrity. As they continue to improve the customer experience, the demand for industrial cold storage warehouse space increases, especially for those 3PL companies that can manage the cold chain better than the average retailer.

Moreover, the surging need for cold storage space for medical and pharmaceutical companies fuels the need for cold storage capacity. One significant challenge that we are witnessing is the demand for cold storage is outpacing supply. As a result, we predict tight cold storage warehouse capacity for the foreseeable future.

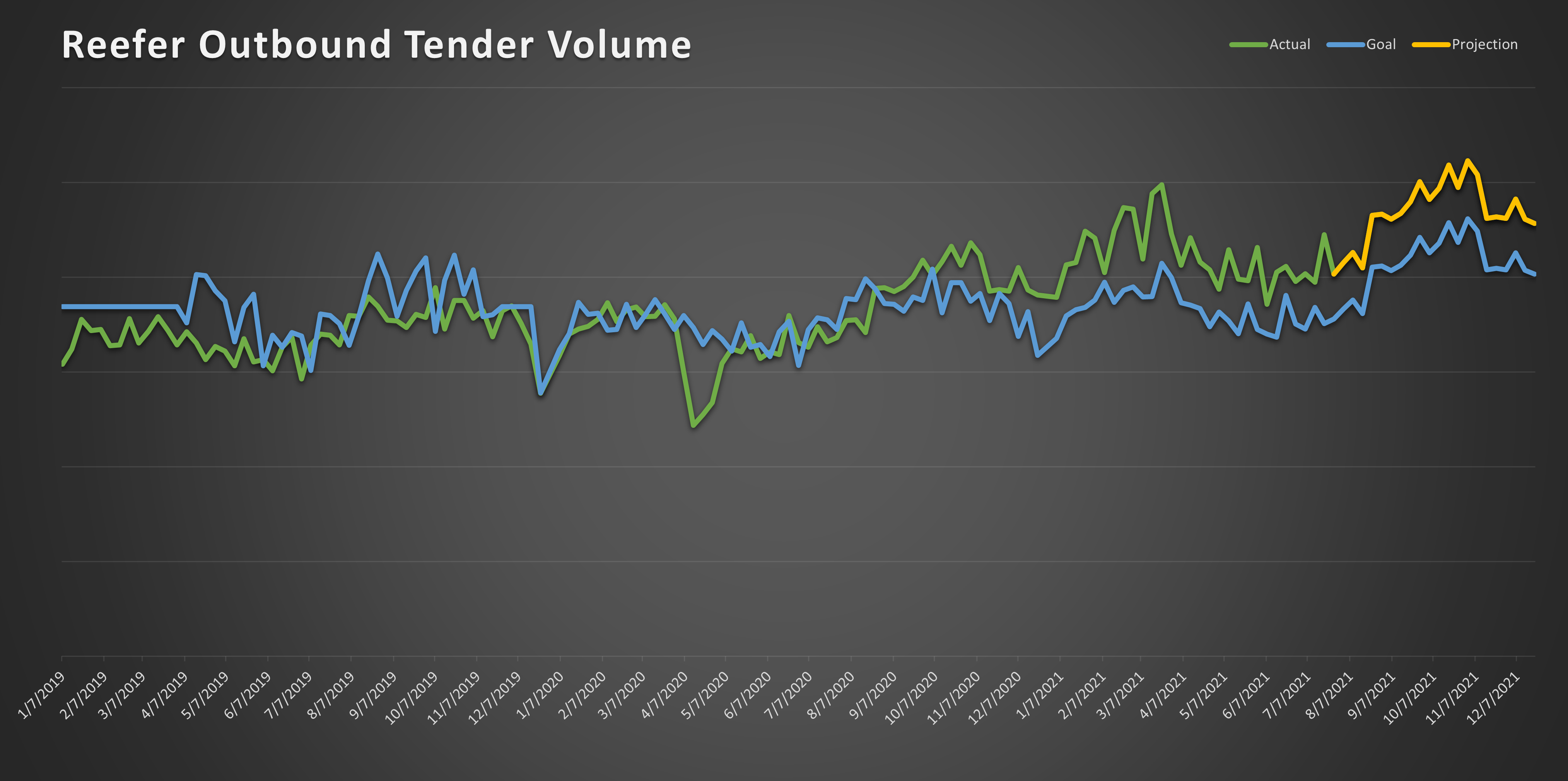

Reefer Outbound Tender Volume

Historically, RLS witnesses a decline of reefer volumes in the Summer months of approximately 25% off the high volume in the fourth quarter. This year the numbers indicate only a 14% reduction off the forecast. The substantial volume signifies a rebounding economy as states continue to ease pandemic restrictions. Typically, we begin to witness increased volumes starting in late August as schools reopen. Volumes then continue to increase throughout the 4th quarter in support of holidays and hold firm for the year’s balance. If the volume has not dropped off this summer, what could we expect this fall and winter? Your guess is as good as ours, but history tells us that volumes are more significant in the 4th quarter than they are in the 3rd quarter, which could lead to an interesting and spicy freight market come Q4. We are paying a lot more for transportation today than we did this time last year, and we do not anticipate it getting better anytime soon.

In Summary, welcome to the Roaring ’20s

The transportation and warehouse market is as hot as the Summertime heat. Trucking and cold storage warehouse capacity is tight; demand and volumes are up. Trucks and warehouses are struggling to come online fast enough to make a rescue. Consumers are spending more than they ever have. Logistics companies deemed essential were under pressure to deliver last year, and we see no slowing down this year. Supplying the country with goods has always been a challenge, and we learned a lot these past few years and will undoubtedly rise to the challenge again.