THE COLD CHAIN SOLUTIONS NEWSLETTER

THE COLD FRONT, ISSUE 8

Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, less than truckload shipping, truckload transportation and eCommerce fulfillment cold chain solutions. As cold chain experts in frozen and refrigerated logistics, we are focusing on these topics for our May 2021 issue: labor and inflation, diesel fuel price outlook, and port congestion. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data you need to make better decisions to fuel your growth. We hope you find this information useful! If you would like data on your specific market, click the button below.

Labor and Inflation

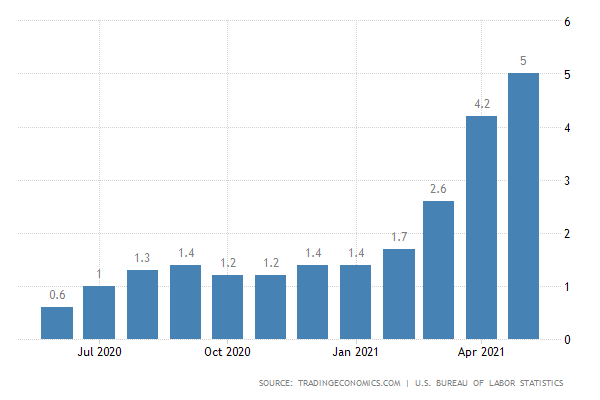

Inflationary pressure is bubbling through the U.S. economy. The amount that suppliers are charging businesses and the amount of money businesses are paying for labor has led to a 5% increase in the consumer price index (CPI) from one year ago. The 5% gain is the highest increase since August 2008, a month before the financial crises we know as the great recession. Although several factors contribute to inflation, we cannot ignore the cost of labor. A recent Business Insider article cited a report by the New York Times, The Amazon That Customers Don’t See, which stated that the hourly turnover rate for Amazon fulfillment center workers is a staggering 150% every year. Many of the 350,000 employees Amazon reported hiring from July to October stayed with the company for days or weeks. This had some executives concerned about running out of hirable employees in the U.S., the report said. This year, like many other companies, including RLS Logistics, Amazon was offering $1,000 hiring bonuses to attract new employees. But, unfortunately, these efforts had little impact on the number of qualified candidates. So when will the labor shortage end? Labor is a hot topic in Washington with no clear answer.

Some believe that when the additional Pandemic Emergency Unemployment Compensation stops in September, it will solve the problem. In contrast, others believe unfair wages, high healthcare, childcare costs, and job competition are causing labor challenges. Only time will tell, but one thing is sure, U.S. companies are in competition for labor and are thinking outside the box to attract and retain those willing and able to work.

The Silver Lining:

Companies will continue to look towards automation in an attempt to do more with less. Companies will also look at how to improve work conditions, which will result in highly engaged employees.

Diesel Fuel Price Outlook

The largest component of what we pay at the pump for a gallon of diesel fuel is the cost of the crude oil purchased by the refineries. The price of crude oil is also the most significant component of what we pay at the pump for a gallon of gasoline. Why then is the national average cost for diesel 7% higher than the cost for gas? The answer is taxes and demand. The federal excise tax for on-highway diesel fuel is $0.06 per gallon higher than gasoline. In addition, the need for diesel fuel is more than gasoline. The United States competes with Europe and China for the world’s crude oil. Those who drive a lot feel the pinch at the pump, and some analysts believe it will worsen. The price per barrel of Brent crude, the international standard, is at its highest level since April 2019, $73.36 per barrel. In a recent interview with Fox Business, David Tawil, president of Maglan Capital, said that he expects oil to continue to rise considerably through the end of 2021 and that the price per barrel could exceed $100, an additional 36%. This sentiment was echoed by Goldman Sachs, who said they would not be surprised if the price per barrel exceeded $100 by the end of the year. There are two main drivers to this increase in crude oil prices; supply and demand and inflation. As the world economy opens up, travel and consumption are increasing. Recently, Royal Dutch Shell announced that it would be selling its holdings in the U.S. Permian Basin, located in Texas, which accounted for 6% of its total oil and gas output last year. Shell and other large oil-producing companies are under pressure to reduce planet-warming greenhouse gas emissions and focus on renewable, hydrogen, and low carbon energy production. The move could trigger other oil giants under intense investor and regulatory pressure to reduce fossil fuel production and limit the supply of crude. The anticipation is that this will adversely affect the price per gallon of diesel for the foreseeable future and urge manufacturers to consider this when negotiating contracts.

Barrel Prices converted to Pump Price:

53% of the cost at the pump attributes to the purchase price for crude oil. A standard 42 gallon barrel of crude oil purchased for $100 per barrel translates to $2.38 at the pump. Add a $0.24 per gallon for federal excises tax and $2.35 to refine transport and market retail. The cost at the pump for $100 per barrel could approach $5.00 per gallon by the end of the year.

Port Congestion

Severe port congestion is hurting international trade and, just in time, inventories. Delays result in enormous costs for importers and exporters, and the lack of predictability and reliability wreaking havoc on supply chains. Coast to coast, the volumes at our ports continue to increase, resulting in a never-ending challenge. The New York and New Jersey ports accounted for 26.6 percent of their volume from China last year. In Oakland, CA, imports from Asia were up 32% in Q1 of 2021 versus 2020. Seattle and Tacoma’s ports saw Asia imports increase 40.3% in the First Quarter of 2021 compared to last year. While most of the capacity issues are causes the operational bottlenecks, labor is making for more problems at the port facilities. Forecasts of inbound shipments according to SONAR show a slight downturn in volume in the upcoming month. We will be keeping a close eye on the effects of capacity and labor at the ports.