THE COLD CHAIN SOLUTIONS NEWSLETTER

THE COLD FRONT, ISSUE 5

Frozen and Refrigerated Cold Chain Insights

Welcome to the fifth issue of The Cold Front, presented by RLS Logistics. We proudly offer nationwide cold storage warehousing, less than truckload shipping, truckload transportation and eCommerce fulfillment cold chain solutions. As cold chain experts in frozen and refrigerated logistics, we are focusing on these topics for our February 2021 issue: reefer spot rates, truck driver shortage, and an outlook on diesel. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data you need to make better decisions to fuel your growth. We hope you find this information useful! If you would like data on your specific market, click the button below.

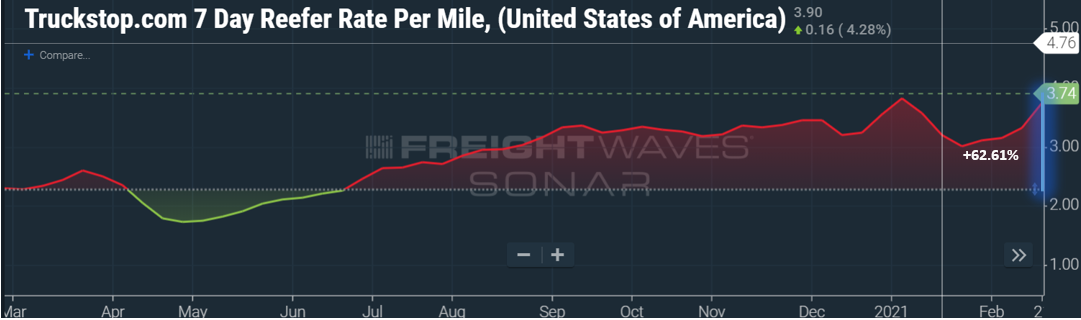

Reefer Spot Rates

The 7-day reefer rate per mile is climbing and shows little indication of letting up anytime soon. Weather events played a significant role in disrupting transportation networks, affecting already tight capacity. Driver shortages, new equipment delays, port activity, and volume increases will continue to create pressure on capacity and drive up rates. Rates are 62.61% higher than where they were this time last year. Much of the increase can be attributed to a rise in per-mile rates; additionally, increased fuel costs are in play. Green shaded areas indicating relatively loose reefer capacity where shippers realize lower rates are getting smaller on the chart below. The red shaded areas indicate tight capacity and substantially higher transportation rates.

Truck Driver Shortage

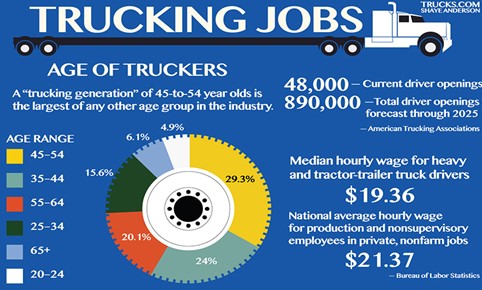

The truck driver shortage is not a new topic and is frequently resurrected when capacity tightens. The American Trucking Association has been a strong voice of concern for this industry dilemma. There is no question that the truck driver shortage has a direct relationship to trucking rates. The infographic below from Trucks.com indicates that approximately 55% of total truck drivers are between 45-65+ years old. Also, the median hourly wage for drivers is about $2.00 less than production jobs. Lower earnings potential coupled with a lower quality of lifestyle hinders new drivers to the industry. The pandemic has not helped. According to reports, in 2020, truck driving schools graduated 40% fewer drivers than previous years. Also, the FMCSA Clearinghouse legislation requires drivers to register into a database that gives prospective employers real time information about CDL driver drug and alcohol program violations. It is estimated that over 45,000 drivers were put into prohibited status due to this new program. The ATA estimates that the industry will be over 100,000 drivers short by 2023.

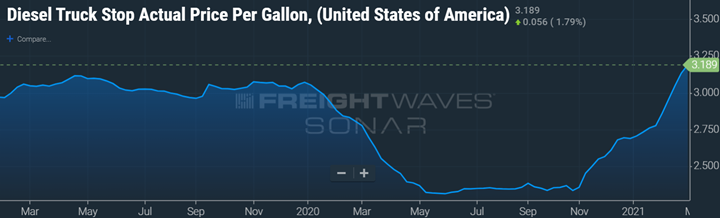

Diesel Outlook

The cost per barrel of oil has increased 63% from November 1st to today. As the global economy and states begin easing restrictions and focusing on economic recovery, oil inventories are expected to drawdown. Congress has passed a $1.9 trillion coronavirus relief bill, the largest stimulus plan in US history, which is expected to fuel a very strong US economic recovery, affecting oil and diesel demand. Oil prices and inflation are connected. As oil prices increase, costs of manufacturing and distribution increase, resulting in higher inflation. As consumers, we will be paying more for our products than we did last year.