THE COLD CHAIN SOLUTIONS NEWSLETTER

THE COLD FRONT, ISSUE 6

Frozen and Refrigerated Cold Chain Insights

Welcome to the sixth issue of The Cold Front, presented by RLS Logistics, the Cold Chain Experts! As cold chain experts in frozen and refrigerated logistics, we are focusing on these topics for our March 2021 issue: reefer spot rates, reefer outbound tender volume and produce, and class 8 truck orders and delays. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data you need to make better decisions to fuel your growth. We hope you find this information useful! If you would like data on your specific market, click the button below.

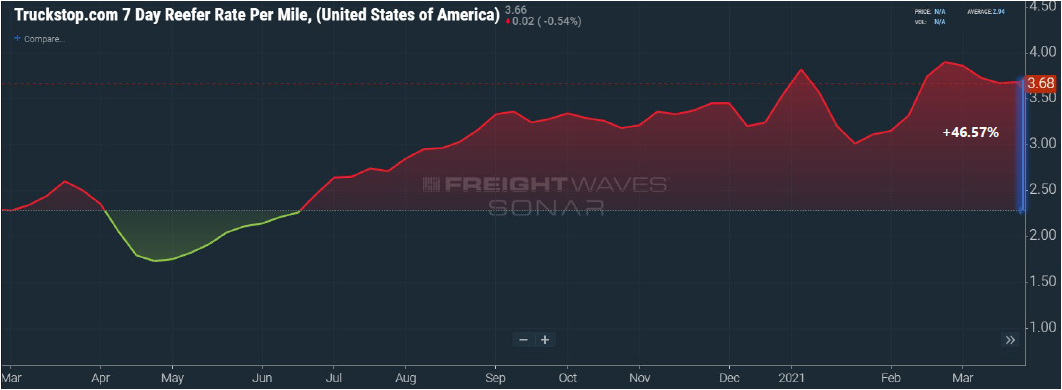

Reefer Spot Rates

The 7-day reefer rate per mile has decreased slightly since its peak in February; however, rates continue to have a stark increase compared to last year. Driver shortages, new equipment delays, port activity, and volume increases continue to create pressure on capacity and drive up rates. According to the Truckstop.com 7 Day Reefer Rate Per Mile, rates are 46.57% higher than they were this time last year. Much of the increase can be attributed to a rise in per-mile rates; additionally, increased fuel costs are in play. Green shaded areas indicating relatively loose reefer capacity where shippers realize lower rates are getting smaller on the chart below. The red shaded areas indicate tight capacity and substantially higher transportation rates.

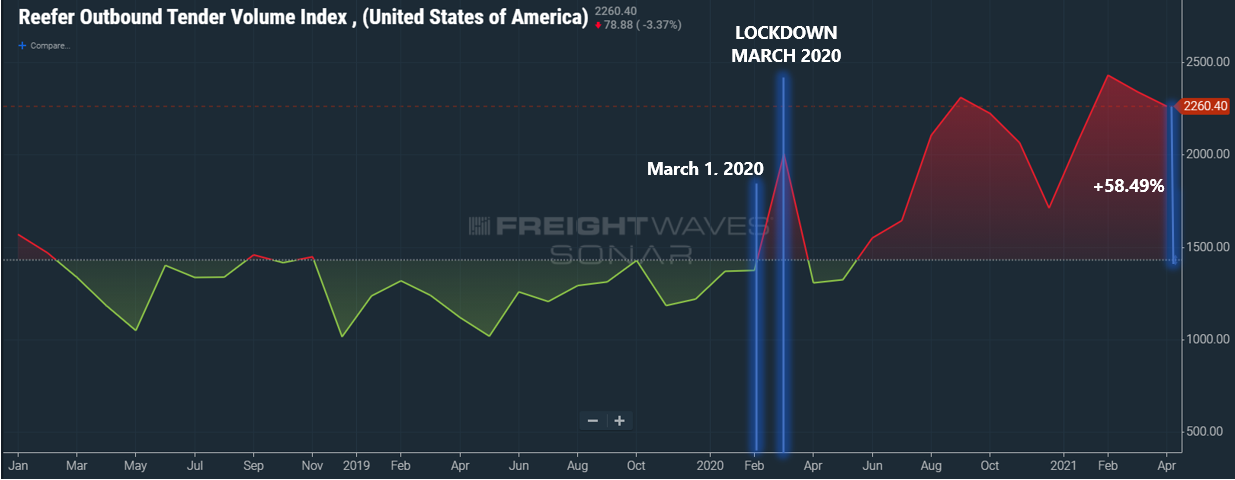

Reefer Outbound Tender Volume and Produce

Although reefer tender volumes dipped 13% from their peak at the end of February, volumes continue their impressive run, rising over 58% since the beginning of the pandemic in March 2020. Reefer volumes are up 37% since they began measuring the index in 2018. Reefer demand continues to be strong. We anticipate this trend to continue as peak produce season begins. Things are already heating up in the southern states. For reefer freight, we are witnessing twelve loads for every truck in some areas. Demand for fresh produce has growers optimistic for a strong season. Consumer mobility is on the rise, and states continue to reduce on premise dining restrictions. There is plenty of pent-up demand for eating out, which is encouraging for food service. Growers are banking on a strong season. The good news for the growers could be bad news for other food manufacturers; we expect reefer supply to be a challenge to secure. We are keeping a close eye on the effects produce will have on reefer capacity.

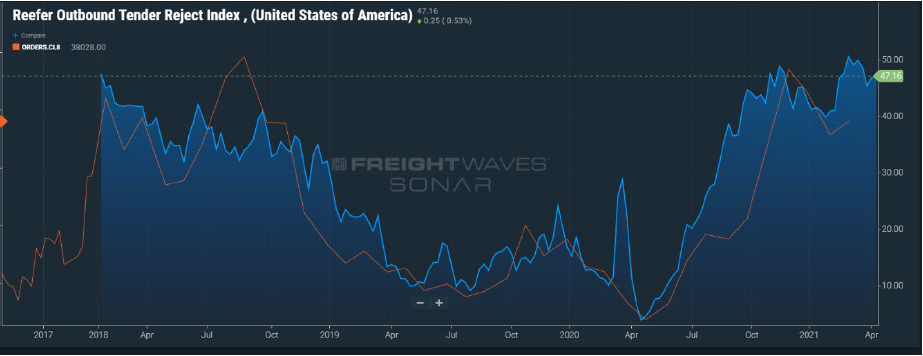

Class 8 Truck Orders and Delays

In our 3rd issue of The Cold Front, we discussed the relationship between Class 8 Truck Orders and capacity entering the marketThe Cold Chain Solutions Newsletter Dec 2020. Historically, new truck orders signaled a reduction in tender rejections and a softening freight market. The orange line on the graph below shows Class 8 Truck Orders. They peaked at the end of November. The blue line is reefer outbound tender rejections. Tender rejections typically begin to subside 5 to 6 months after truck orders start to subside. If this holds true, we should start to see some relief come June/July this year. Truck orders have topped 40,000 units for six months in a row. This volume represents an annual increase of 20% over the last 12 months. The additional supply will be a welcomed relief for shippers, but not so fast; component shortages of semiconductors and other parts are causing problems in the supply chain. Trucks that are ordered today have an early 2022 delivery timeline.

In addition to the shortage of components, the industry is not immune to the labor shortage and a slow supply chain due to port congestion. These factors could extend the lag between truck orders and additionally supply entering the market. We continue to keep watch on all of these moving parts.