THE COLD CHAIN SOLUTIONS NEWSLETTER

THE COLD FRONT, ISSUE 12

Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage and eCommerce fulfillment cold chain solutions. As cold chain experts in frozen and refrigerated logistics, we are focusing on these topics for our February 2022 issue: transportation capacity, reefer rates, and cold storage warehouse capacity. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you would like data on your specific market, click the button below.

Transportation Capacity

In September’s issue of the Cold Front, we discussed transportation supply, demand, and coverage of the freight. 2021 sure was a challenging year for the transportation industry. We saw tender volumes and rates skyrocket while capacity tightened.

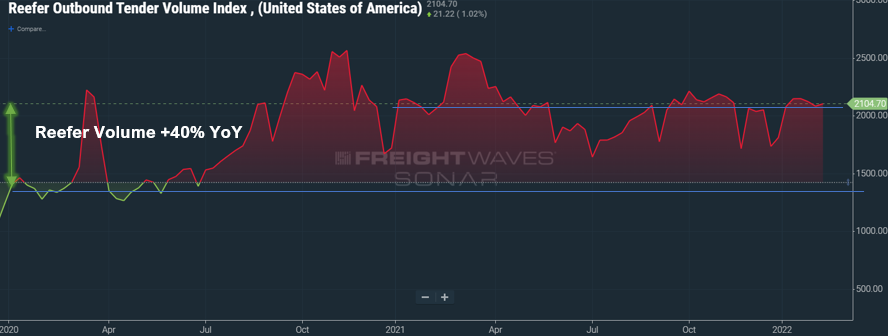

The graph below shows outbound tender reefer volume from 2020 until today. Reefer volume is up 40% since 2020 and up 18% from 2021. Freight demand remains strong even with high inflation. Port congestion continues to plague the supply chain as imports continue modest growth. Although container ships waiting off the coast of Southern California are subsiding, container vessels waiting to berth on the east coast are rising. Additionally, future arrivals are projected to increase. Even with high inflation, the demand for goods remains strong, but for how long? The Federal Reserve signaled a plan to raise interest rates beginning in March 2022. The effects of increased interest rates tamper demand. However, even with a demand reduction, the backlog in the supply chain is expected to carry transportation to another strong year for 2022.

Reefer Rates

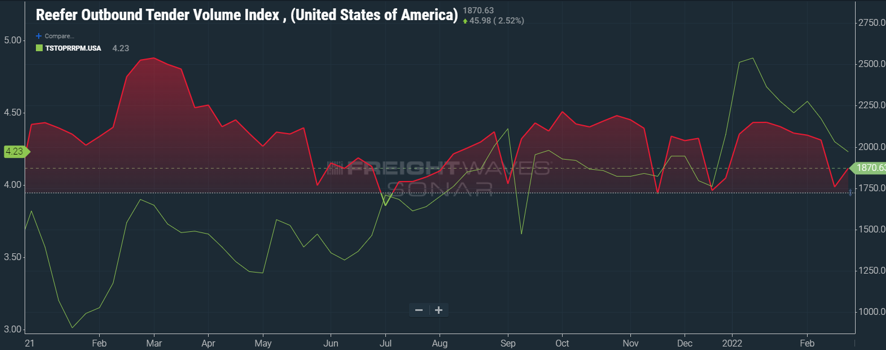

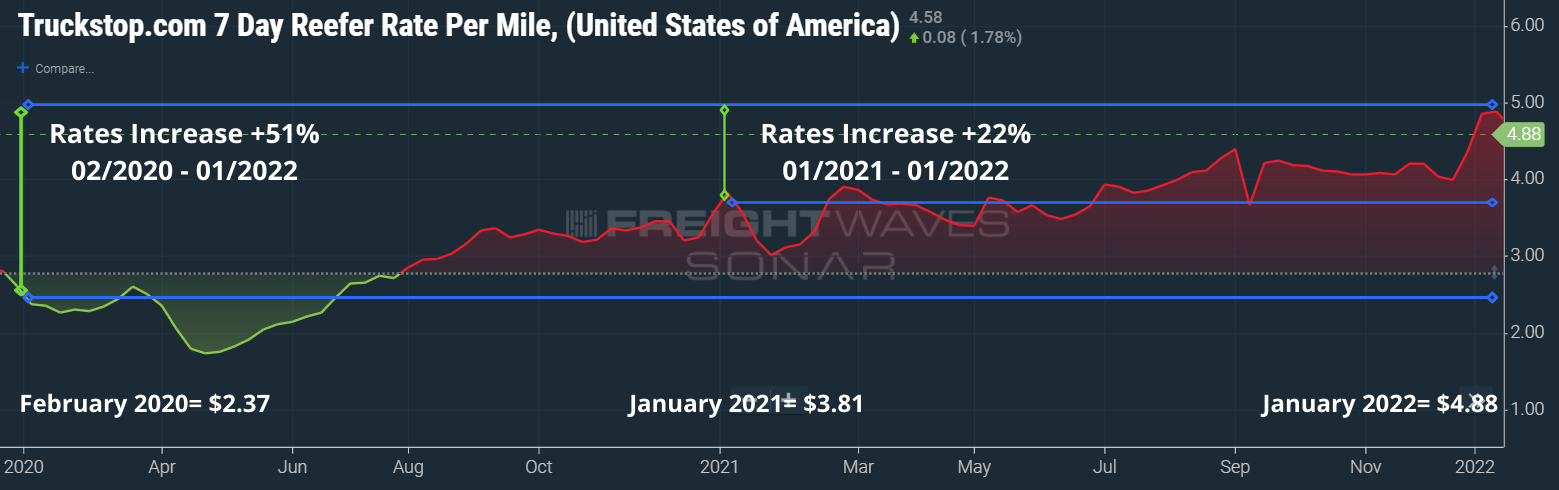

The graph below shows massive increases in reefer rates from 2020 to today. According to truckstop.com’s 7 Day Reefer Rate per Mile, the spot market rates have increased approximately 51% since January 2020 and 22% from the start of 2021.

2021 was an extremely volatile year for the trucking industry, setting new records on rates and volume and new standards on driver pay and experience. Many trucking companies increased driver pay more than a few times this past year, struggling to recruit and retain long haul truck drivers. The industry faces a driver shortage of approximately 80,000 drivers, that number is expected to climb. Trucking companies are struggling with adding drivers, and acquiring additional equipment is also a challenge. Truck manufacturers were limited in their 2021 production output, rolling over into 2022. The used equipment market continues to be hot; used trucks are reported selling +45% from the previous year and are expected to be strong throughout 2022. These factors will set the stage for high freight rates for the remainder of the year.

Cold Storage Warehouse Capacity

The driver shortage and strong freight demand is not the only story of the current state of the supply chain. We are also seeing a shortage of cold storage warehousing capacity. The pandemic saw a sizable shift in consumer purchasing habits from in store to direct to consumer. This shift created additional SKUs and new networks to keep up with high demand and prompt delivery. The change in consumer habits and buying trends have increased the need for warehousing capacity across the U.S. Manufacturers have shifted from a just in time mindset to a safety stock approach, causing additional demand for inventories – a topic we discussed in our May 2021 issue of The Cold Front.

According to the United States Department of Agriculture (USDA), gross refrigerated warehouse capacity totaled 3.73 billion cubic feet in October 2021. The graph below illustrates the total available warehouse space in the United States. Currently, 96.4% of warehouse capacity is spoken for, and only 3.6% of storage remains vacant.

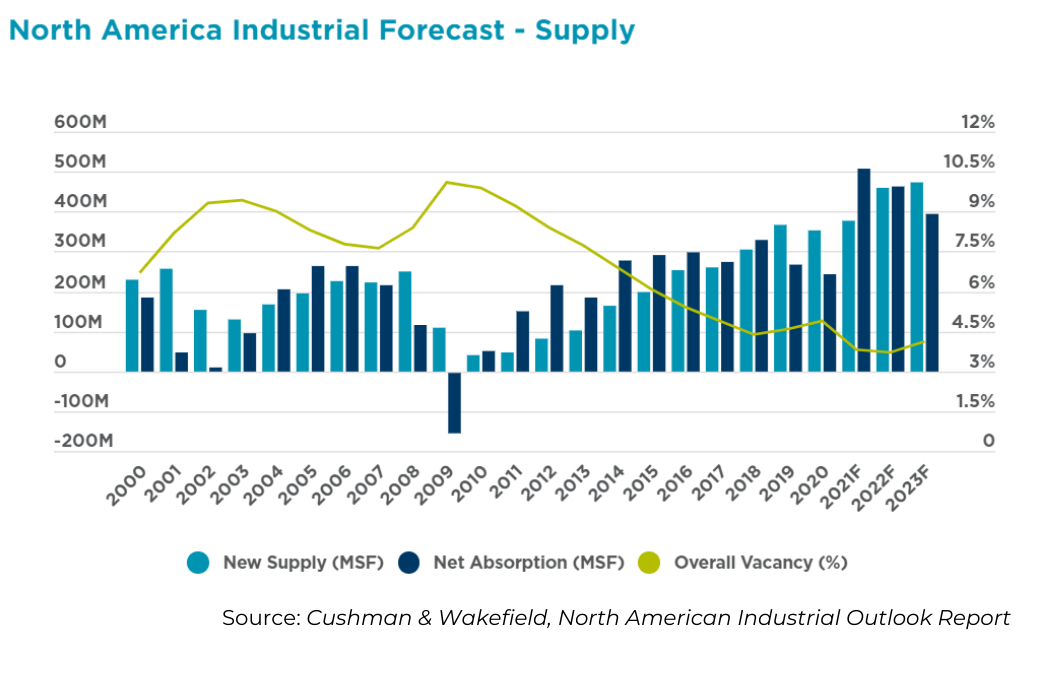

In 2021, the supply of warehouse space was trailing demand significantly. However, warehousing demand is expected to remain strong for 2022 and beyond as the need for warehouse space outpaces supply, as reported by Cushman & Wakefield’s North American Industrial Outlook Report. Additionally, as manufacturers continue to ramp up production, finished goods inventories are expected to remain vital for the foreseeable future. Food manufacturers are still feeling the sting of depleted inventories from the height of the pandemic.