THE COLD CHAIN SOLUTIONS NEWSLETTER

THE COLD FRONT, ISSUE 13

Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage and eCommerce fulfillment cold chain solutions. As cold chain experts in frozen and refrigerated logistics, we are focusing on these topics for our April 2022 issue: diesel fuel, container imports, and cold storage warehouse inventories. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you would like data on your specific market, click the button below.

Diesel Fuel

On May 9, the Department of Energy reported that national average diesel fuel prices hit an all time high at $5.623 per gallon. Diesel has risen disproportionately compared to other benchmark oil prices, such as retail gasoline and crude oil. Diesel prices are up 55% from the start of the year; a gallon of diesel fuel costs $2.00 more per gallon than in January.

California, followed by New England, tops the regions with the highest average price per gallon, and things could get worse. California’s annual increase in the state’s gasoline tax is scheduled to take effect on July 1. Legislatures in California refused to suspend the annual increase this year, further exasperating the already high fuel price. California’s annual increase is set to take place on July 1 and represents an additional 5.6% increase.

In a recent Freightwaves article titled “Why the Northeast is Quietly Running out of Diesel,” the outlook for fuel prices here in the northeast does not show any signs of subsiding. The article details the reduced amount of diesel in inventory in the northeast. Historically, the northeast stores approximately 62 million barrels of diesel in May. However, this May, that number reduced to 51 million barrels of diesel for the area. Some predict that the northeast may need to ration diesel this summer, something the industry has never experienced before.

The outlook for diesel does not show any signs of subsiding. On the contrary, some predict that we could see the price of both gasoline and diesel will continue to increase throughout 2022.

Container Imports

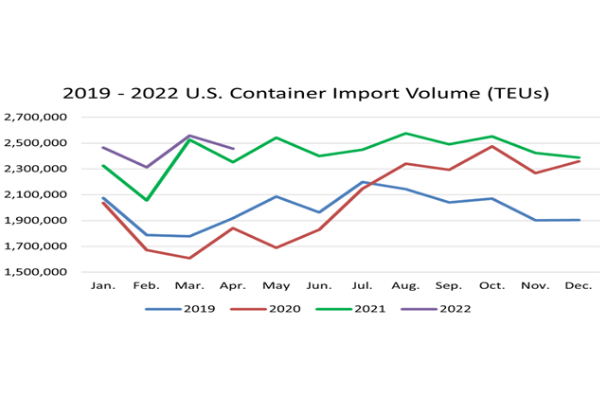

Global shipping volume remained strong in April despite shutdowns in China, the Russia-Ukraine conflict, and record high inflation. Although container import volumes were down 4% compared to March, April set another monthly record compared to 2021. April 2022 volumes were up 28% from pre-pandemic April 2019. With the recent announcement to end China’s Shanghai Covid lockdowns by June 1st, we anticipate container import volumes to remain strong, even given inflationary pressure.

Import volumes continue to shift from west coast ports to east coast ports. East coast ports increased volumes.

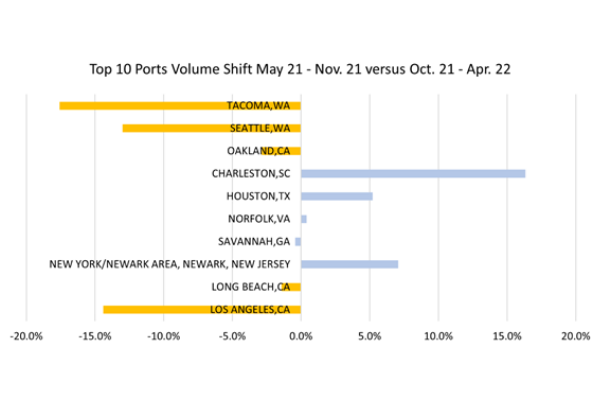

Import volumes continue to shift from west coast ports to east coast ports due to the ongoing backlog at the Southern California ports. East Coast ports handled 45% of all imported volumes from April. Additionally, inbound containers shift from the top larger ports to alternative ports.

The chart below shows the volume shift by port. Again, supply chain predictability is trumping total transit times and costs, as seen in the movement of goods to the less congested port of calls.

Cold Storage Warehouse Inventories

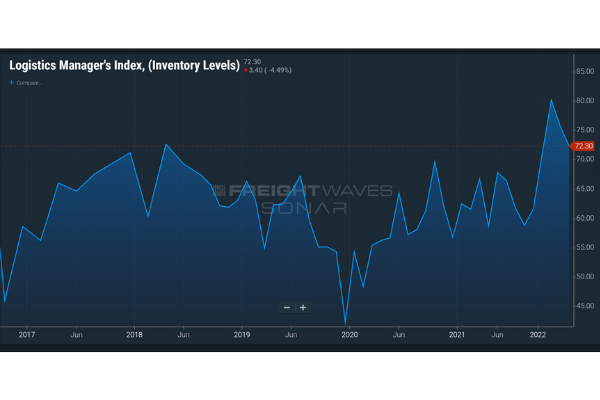

Inventory levels are high and cold storage warehousing capacity remains tight in most markets.

Manufacturers continue to shift from a just in time inventory strategy to a just in case strategy, resulting in higher holdings of inventories. Additionally, a growing direct to consumer shopping experience has elevated SKU counts resulting in additional stocks. We continue to field daily requests seeking inventory availability on both coasts. California inventories remain strong with little temperature controlled capacity available in the market. Most likely tied to imports shifting from the west coast to the east coast, we see minimal capacity available in the market. Cold storage warehousing is a hot commodity for the foreseeable future.

The below graphic shows that although inventories have declined from their peak index level earlier this year, they remain higher than pre pandemic levels of 2018. We predict inventories to stay high as manufacturers begin to build for the 4th quarter.