Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage and eCommerce fulfillment cold chain solutions. As cold chain experts in frozen and refrigerated logistics, we are focusing on these topics for our November 2022 issue: fuel crisis, truck tonnage, and looming rail strike. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you would like data on your specific market, click the button below.

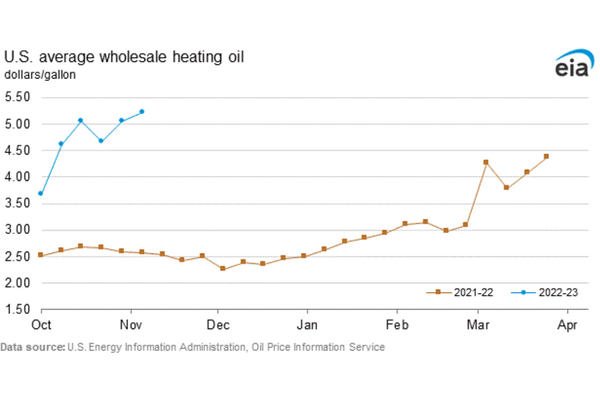

What’s Happening with Diesel Fuel?

An alarming report from the Energy Information Administration (EIA) from October showed the lowest distillate fuel inventory since October 2008. Although the Department of Energy has reported a slight increase in distillate supplies in November, demand for the supply rises in the winter months with more home heating oil needed. Distillate stores showed a modest increase from 25.4 days in October to 26 days in November. However, diesel prices continue to be high, with New England being the highest at $6.060 per gallon, $2.40 per gallon higher than a year ago. According to a recent article, “Four Reasons Why the U.S. Is Grappling with a Diesel Shortage,” by Oil.com, the cut-off of nearly 700,000 barrels per day of petroleum and petroleum products from Russia is the primary reason for the low inventory of distillate supply. Competition for distillate should keep home heating oil and diesel prices high for the foreseeable future unless demand significantly declines.

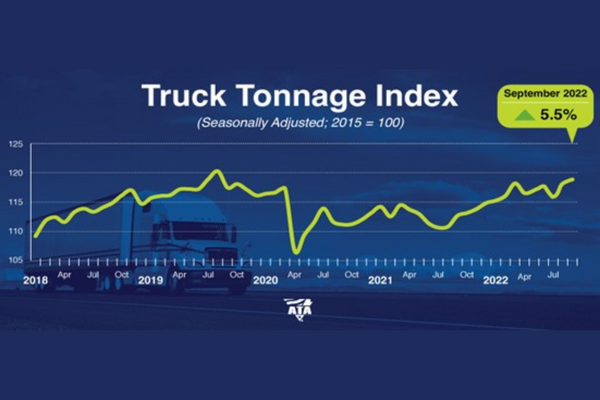

Truck Tonnage Remains Strong

The American Trucking Associations’ for-hire truck tonnage showed a slight increase of 0.5% in September after increasing by 2.1% in August. The index was 5.5% higher compared to September 2021. According to ATA Chief Economist Bob Costello, the increase is an example of how the contract freight market remains strong, despite a weakening spot market. October 2022 tonnage has not been released at the time of this issue. Thus far, 2022 has been a volatile transportation market. According to FreightWaves, Sonar reefer outbound tender volume was substantial at the start of the year but began its decline in April. However, since July, at the low, the Reefer Outbound Tender Volume Index has increased by 25%. Although we have witnessed looser capacity from the turbulent times in 2021 and the beginning of the year, fuel costs and relatively strong tonnage have plateaued rates. Trucking is a leading barometer of the U.S. economy; all eyes will be on the October and November truck tonnage index report.

Special Segment: Rail Strike in December?

Seven of the twelve total rail unions have agreed to ratify the tentative deal brokered by the Biden administration back in September; however, two unions rejected the deal in October, and three more have yet to vote as of the writing of this issue of The Cold Front. The Brotherhood of Maintenance and Way Employees Division (BMWED), the third largest rail union, recently extended its status quo period from November 19th to December 9th. The news is a relief and averts a possible strike just before the Thanksgiving Holiday, the busiest travel time of the year, and offers more runway to negotiate for ratification. The main issue is paid sick time equivalent to federal employees. The conflict stems from a classification that rail workers were classified as federal contractors for the vaccine mandate. As a result, workers are asking for 56 hours of paid sick time off that current federal contractors are offered.

According to an interview on November 9th by CNBC with Lance Fritz, CEO of Union Pacific, he believes the extension will allow all parties to complete the ratification without disrupting rail services. Fritz is quoted as, “That doesn’t mean a strike is not possible; it just means, in my opinion, I don’t think it’s probable. We’ve got plenty of runway to figure it out.” We sure hope that Mr. Fritz is right. According to the Association of American Railroads, if railroads did not move freight in the U.S., it would take over 99 million additional trucks traveling on public roadways and four times more distillate fuel to handle the cargo. Truck driver shortage, diesel prices, and diesel supply are all hot topics for the trucking industry. A rail strike could cripple an already fragile supply chain. We hope all 12 unions agree to ratify a newly negotiated agreement before December 9th to avoid major disruption.