Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage and eCommerce fulfillment cold chain solutions. As cold chain experts in frozen and refrigerated logistics, we are focusing on these topics for our January 2023 issue: container imports, trucking capacity & carriers, and rising energy costs. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

Container Imports

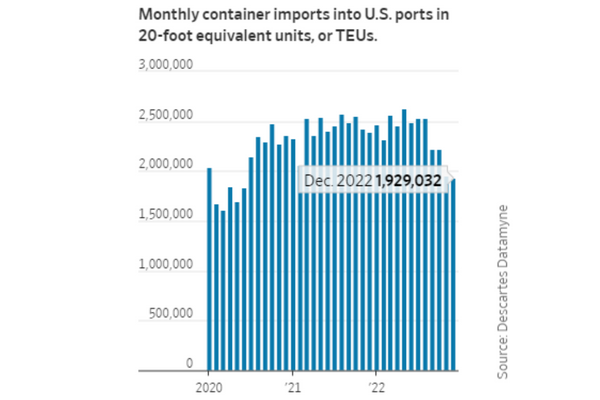

In our December issue of the Cold Front, we discussed the decline of U.S. imports, which started to decrease in volume in November 2022. The downfall of volume has not shown any signs of stopping, which could be attributed to international trade declining as inflation takes hold of consumer demand.

The Global Port Tracker predicts that January import volumes will fall 11.5% from last year, and February may slip another 23%. Our cold chain experts will closely watch this and the price consumer index as the first quarter continues.

Trucking Capacity & Carriers

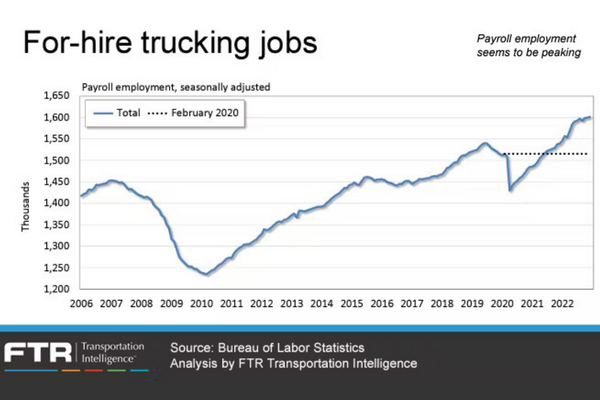

The robust transportation market we witnessed in 2021 and early 2022 has cooled significantly. Spot and contract rates have cooled off; however, trucker costs remain high. According to a recent article in Fleet Owner, the trucking industry lost more carriers in December 2022 since 2005. The below graph represents new for hire carriers with fewer revocations reported by the Federal Motor Carrier Safety Administration (FMCSA). According to Avery Vise of FTR Transportation Intelligence, the trend will continue. A reduction in trucking companies does not necessarily mean a reduction in available drivers. According to the article, most carriers are independent, with several truck operations; those drivers tend to return as company drivers for larger trucking companies. Small carriers with less than ten trucks account for 95% of all trucking companies. Carriers with less than 20 trucks handle much freight moving over the road. Keep an eye on trucking bankruptcies in 2023.

Energy Costs on the Rise

In addition to increased household goods costs due to inflation, the cost of energy per household is expected to be higher than usual for Americans this winter, according to an article by U.S. News. According to the report, average household expenditures for natural gas are expected to increase by 28%, heating oil to increase by 27%, electricity by 10%, and propane by 5%. These increases are forecasted to project the second largest year over year energy increase in the past eight years.

According to data from the EIA, 27% of households are experiencing energy insecurity, which means they face issues with paying energy bills on time or keeping homes at unsafe temperatures. Food and energy represent a significant portion of all household expenditures. The increased costs for food and energy could continue to temper demand and shift brand loyalty to more economical options. We will continue to monitor energy and how it relates to demand throughout 2023.