Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage and eCommerce fulfillment cold chain solutions. As cold chain experts in frozen and refrigerated logistics, we are recapping and highlighting 2022’s hot topics for this issue: transportation capacity, container imports, and diesel fuel. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you would like data on your specific market, click the button below.

Transportation Capacity and the State of the Economy

Our February 2022 cold front issue highlighted the reefer capacity market. At the time, reefer tender volume was up 40% since 2020 and 18% from 2021, a significant increase that wreaked havoc for shippers trying to manage transportation budgets. The Federal Reserve signaled a plan to increase interest rates in March 2022 to tamper with demand. Not only did the Federal Reserve make good on that plan, but it also raised interest rates seven times in 2022. Although we have seen some inflationary relief, a significant impact was in the transportation markets, reducing demand. The below index demonstrates the sharp decline in transportation reefer volume. The reduction in volume has swung the pendulum towards shippers, who now have more capacity options when moving their freight. The big question here; is when we will hit bottom. The reefer outbound tender volume index shows the reduction of volumes to 2018 & 2019 levels. Our cold chain experts monitor market conditions closely and will report in future cold front newsletters.

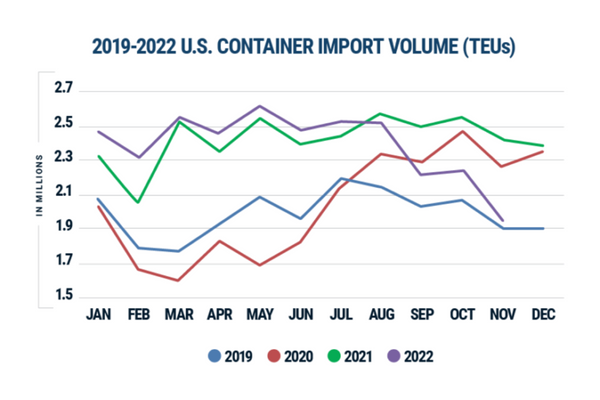

Container Imports

Our April 2022 cold front issue highlighted high container import volumes as the world witnessed the Russian-Ukraine conflict. During this period, China had announced easing covid lockdowns in Shanghai, which was predicted to exasperate container volumes into the US. Lastly, we witnessed a shift from west coast ports to east coast ports to avoid congestion. Container imports have cooled off from earlier in the year. According to an article from Descartes Datamyne, container imports in November reduced by 19% compared to the same period in 2021 but are at 2019 levels. As a result of reduced volumes moving through the ports, shipping delays have seen significant improvement, especially on the west coast. East coast ports are seeing decreasing delays, but not at the same level as west coast ports. That could be attributed to the container shift from west coast ports to the east coast we witnessed earlier in the year. Additionally, rates from China to west coast ports have dropped 90% from last year. We may have turned a corner, and future demand is cooling, making it a favorable market for shippers importing and exporting from US ports.

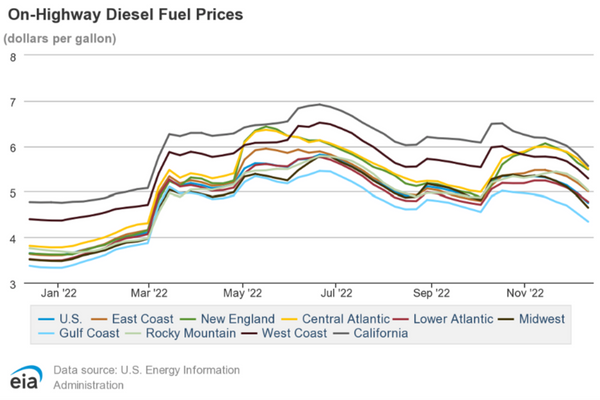

Diesel Fuel

In the Cold Fronts’ April 2022 and November 2022 issues, we discussed the state of diesel fuel in the US. In April, an article titled “Why the Northeast is Quietly Running out of Diesel” was in the news. Inventories were at historic lows, and a prediction of rationing seemed imminent. What happened? Has the economy and demand subsided, so this is no longer a concern? Was it politically motivated to paint a picture? Although diesel prices remain higher than average, we no longer hear the need to ration diesel fuel. Our November release highlighted a report from the Energy Information Administration (EIA) stating that distillate fuel inventories were the lowest since October 2008. Distillate fuel competes between home heating oil and diesel fuel which keeps upward pressure on both energy sources. Has demand subsided to a level where low inventory and competition are no longer an issue? We don’t believe we have seen the end of the energy conversation and are keeping a close eye on diesel.