Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our April 2023 issue: diesel fuel, energy costs, and freight demand. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

Diesel Fuel

On Sunday, April 2, 2023, OPEC announced that it would reduce oil production to 1.16 million barrels per day which was expected to increase prices in the United States immediately. Since the announcement, US National Average Gasoline prices have increased by 5%, but National Average Diesel prices have increased only 0.25%. We suspect the contrast between the comparable increase could be related to the very soft freight market we are witnessing. In short, as Americans prepare for summer travel plans, the gasoline demand is more significant than diesel. Additionally, the competition for diesel production and home heating oil is all but over for most areas of the country. Americans keep moving, but they are not buying the goods they once were, leaving the freight market with the lowest volumes YTD in early April 2023. If freight demand continues at current levels, we expect diesel fuel prices to remain flat. But, there could be another factor at play regarding the reduced production. The graph here depicts OPEC’s capacity to produce oil and OPEC’s output. Those lines are close to an intersection, which could be another reason for the reduction in production. Some economists have predicted a slight increase in freight volumes later in the year which may negatively affect the cost per gallon of diesel and fuel surcharges in the fourth quarter. Either way, we will continue to keep an eye on diesel pricing.

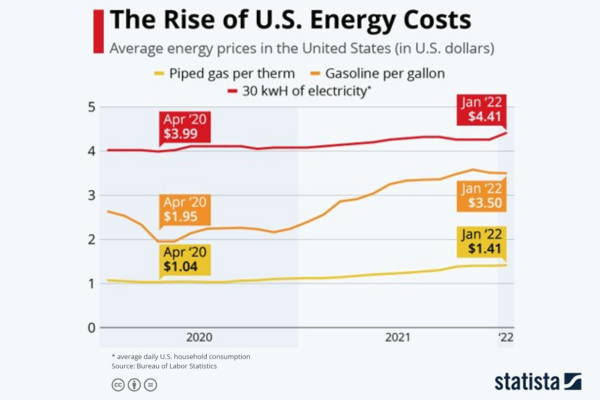

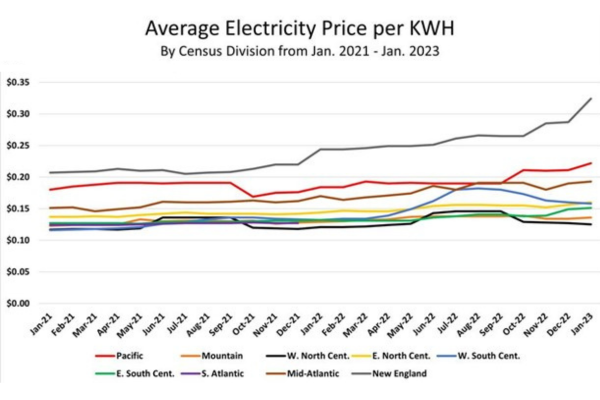

Energy Costs

Keeping with the theme of energy costs, we should recognize the increased prices we have been witnessing in delivered electricity. Behind labor, electricity is the second largest operating expense for a cold storage warehouse. Refrigeration technology utilizes electricity and pressure to remove hot air inside the building to keep interior temperatures low. This need for constant power is one of the reasons why the need for many kilowatts of electricity is utilized at cold storage facilities. So far this year, electricity costs at our cold storage warehouses are significantly higher than during the same period last year. Striking a balance between more economical energy contracts and providing the appropriate supply quantity is a complex strategy requiring attention to detail. Some experts say that the spike in electricity from 2022 to 2023 will subside, but the electricity demand will continue to increase with the push for more clean energy and EVs. We will always focus on energy, specifically the electricity cost.

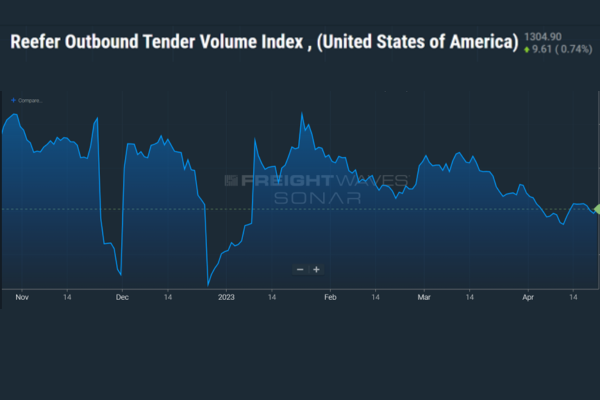

Freight Demand Remains Lows

The below chart from FreightWaves Sonar shows reefer outbound tender volumes from November 2022 to April 2023. According to the data, reefer outbound freight tenders have declined 10% since March 15, 2023. The lower demand may explain why diesel prices have not increased as much as gas prices have since OPEC announced their production cuts. It is clear that things are slowing down, but how that will affect the global economy and manufacturing is still being determined. Shippers are enjoying this market compared to the past two years; however, they are also witnessing a slowdown and may be at a crossroads of when to cut labor to reflect the current conditions. We imagine it is a hard pill to swallow; just a short time ago, it was challenging to find the labor; now that we have it, do we need it? So many factors are in play that it is hard to predict the future, but we suspect volumes to plateau for some time before picking back up late in Q4 or possibly early 2024.