Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage and eCommerce fulfillment cold chain solutions. As cold chain experts in frozen and refrigerated logistics, we are focusing on these topics for our March 2023 issue: industry trucking failures, food inflation and pending recession, and eCommerce fulfillment market. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

Industry Trucking Failures

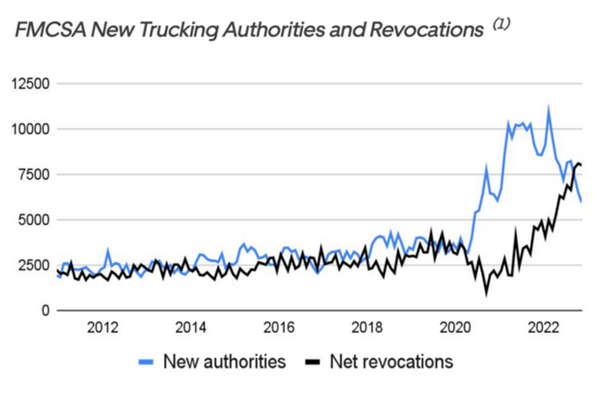

In October 2022, RLS presented a comprehensive overview of the transportation industry to private label manufacturers at the NFRA Conference. Following the presentation, we provided a prediction for the upcoming year. Specifically, we predicted a substantial increase in trucking failures for 2023. This trend is largely attributable to independent trucks and owner operators who expanded their fleets to capitalize on a thriving spot freight market in 2021 and early 2022 but are now struggling to remain profitable. Additionally, even company drivers who ventured out independently have been affected by this market downturn. As the spot market freight demand subsides and these carriers contend with mounting expenses such as inflated equipment costs, heightened insurance premiums, elevated diesel prices, and decreased freight volume driving prices down, carrier revocations have reached unprecedented levels. A recent article by FreightWaves “Uber Freight Expects ‘broad based volume recession,” presented this graph depicting a decline in new authorities and an increase in net revocations reported by the FMCSA. If this trend continues and volumes increase, it could make for a challenging second half of the year. We will continue to monitor trucking failures and freight volumes as we progress through the year.

Food Inflation and Pending Recession

The rising food prices at both retail establishments and dining venues continue to be a pressing concern among the consumers. The Federal Reserve’s recent decision to increase interest rates by 25 basis points is an attempt to delicately balance the need to combat inflationary pressures while avoiding the risk of a potential economic recession. Despite ongoing discussions among economists regarding the likelihood and severity of a possible recession in 2023, the latest data from tradingeconomics.com predicts that food inflation rates may reach 9.2% by the end of the current quarter and decrease to just under 5% by 2024. However, the topic of food insecurity remains a major challenge.

According to the World Food Programme (WFP), an estimated 345 million people globally are predicted to experience food insecurity in 2023, more than double the number reported in 2020. The pace of this increase in demand far exceeds the funding necessary to address the problem. With rising costs associated with delivering food assistance, 2023 is expected to be the WFP’s most challenging year in its goal to end world hunger by 2030. Given these concerns, the Federal Reserve is expected to continue to increase interest rates in 2023. As we continue to monitor the economic impact of these efforts to curb inflation, we must remain vigilant about the ongoing challenges posed by food insecurity both domestically and globally.

eCommerce Fulfillment Market Boom

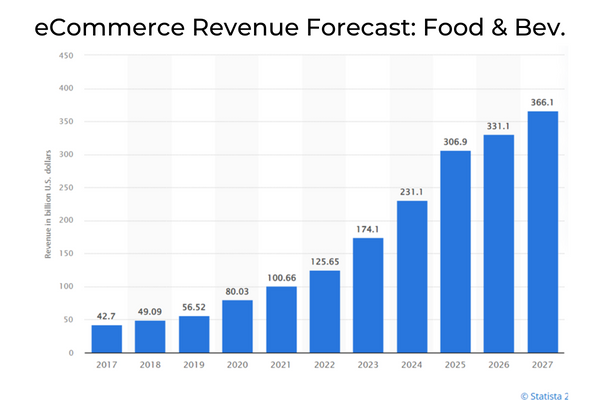

Although RLS’ direct to consumer eCommerce business has grown significantly, this is not a new concept for the company. RLS Logistics has been fulfilling orders directly to consumers for over two decades, and deeply understands this model. RLS is committed to investing in its future growth. According to a Oberlo, an estimated 218.8 million US consumers will shop online in 2023, representing 65% of the population. Ecommerce sales are projected to account for 20.8% of worldwide retail sales. Furthermore, this growth is expected to exceed 24% by 2026. According to Statista, revenue from the ecommerce food and beverage industry is anticipated to reach $174.1 billion in 2023, a 38.5% increase from 2022. The sustained expansion of ecommerce may impact future warehousing capacity, which is already tight. We will continue to monitor all factors that affect temperature controlled warehousing capacity.