Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our June 2023 issue: diesel fuel, West Cost Ports, and the current trucking market. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

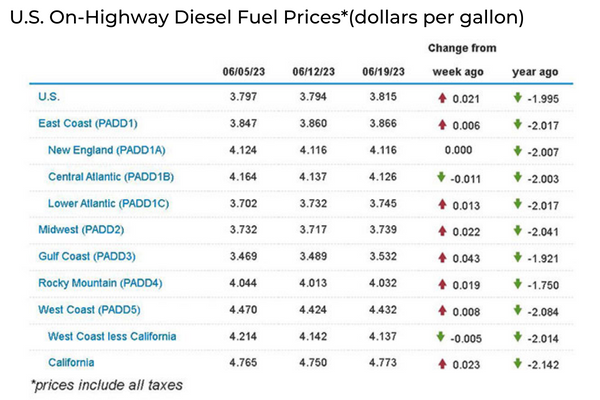

Diesel Fuel Prices

While National diesel fuel prices have decreased by an average of $1.995 compared to this time last year, there has been a recent increase of $0.02 per gallon at the pump in mid-June. This sudden price hike may indicate a bottoming out of the market demand for on-highway diesel. Despite relatively consistent freight volumes, it is no surprise that pricing tends to increase in the weeks leading up to a holiday.

In addition to this seasonal factor, the recent surge in pump prices aligns with a decision made by OPEC to reduce oil production, which we discussed in our April issue of the Cold Front. Additionally, U.S. energy companies have significantly scaled back oil and gas drilling activities, reaching their lowest levels since April 2022, as reported in a June article by Reuters. Industry experts caution that the market may further tighten due to Saudi Arabia’s plan to slash output by 1 million barrels daily in July. If the transportation market experiences a rebound in the second half of the year while supply is being reduced, we can expect the higher fuel costs to play a factor in transportation pricing.

West Coast Port Labor

A tentative agreement between the Pacific Maritime Association and the International Longshore and Warehouse Union was announced after two weeks of labor slowdowns and work stoppages that threatened to disrupt domestic supply chains. The new contract term is six years long and includes workers at all 29 west coast ports. The details of the deal have yet to be released, and it could take months for final approval by the members of the ILWU to ratify. However, all signs point to a successful collective bargaining process.

The recent port disruptions come off the heels of a fragile supply chain we witnessed during the pandemic. Labor struggles coupled with off-the-chart demand created an unprecedented backlog of vessels sitting off the west coast ports waiting for a berth. The West Coast ports’ struggles in 2022 had many importers scrambling to reroute shipments to other ports in the country, raising the question of whether they would ever go back. According to Reuters, the deal has many U.S. Importers who shifted cargo away from West Coast ports bringing some of the volumes back. The re-shifting of containers from China to the West Coast was bound to happen; it remains the fastest transit and most cost-effective mode for importers. Even so, it is inevitable that some volumes shifted to the East Coast will stick, as maintaining inventory closer to the population is still a wise strategy. Although, current water levels at the Panama Canal are restricting vessel passage and container movements.

Current Trucking Market

Tough economic conditions persist in the trucking industry, but signs indicate that we may have hit bottom, and things could slowly improve. In the latest update from ACT Research, the DOT operating authority shows 13,000 net revocations of authority since October 2022. Revocations coupled with the U.S. trucking industry shedding approximately 100,000 jobs in 2023 is right-sizing supply to fit demand. Additionally, the DAT Trendlines Spot Rates forecast below shows rates will begin a rebound in the second half of this year. Although, other experts predict a slow volume rebound and recovery that won’t be persistent until early 2024. The verdict is out, but one thing is evident, the market is volatile, and a simple weather event can cause it to shift; we are entering hurricane season.

According to ACT research, the freight market experienced its first decline 17 months ago, and the past three freight shipment downcycles have ranged between 21 and 28 months, so we should begin to see volumes increase by the end of 2023 or early 2024. Other costs to operate are putting pressure on trucking companies. Driver wages, insurance, interest rates, and increased equipment costs are making this year a challenge on the balance sheet. Those carriers who can weather the storm should be better positioned for an economic turnaround in 2024.