Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our May 2023 issue: truck tonnage and GDP, diesel, and cargo fraud. The Cold Front is a monthly summary highlighting pertinent cold chain market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

Truck Tonnage and GDP

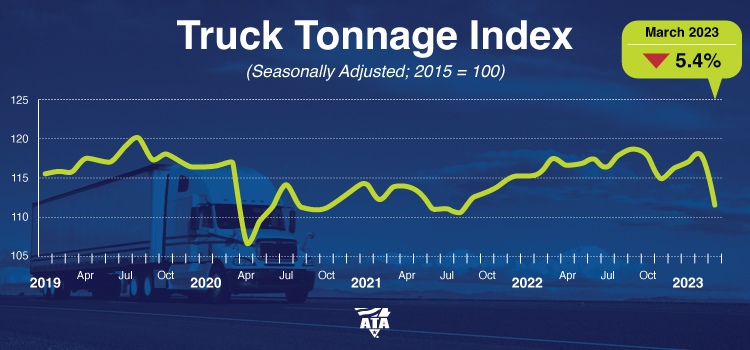

The American Trucking Association (ATA) recently released data regarding the state of the trucking industry. In March, the seasonally adjusted for-hire truck tonnage index experienced a significant decline of 5.4%. This downturn marks the most substantial drop in the index since the pandemic’s beginning in April 2020. To put this into perspective, the index had shown a promising 2.6% increase in the three months before this decline. Bob Costello, the chief economist of the ATA, attributed this negative trend to multiple factors. Falling home construction, decreased factory output, and soft retail sales have all negatively impacted the contract freight tonnage that dominates the index. It is essential to recognize the significance of the trucking industry as a barometer for the overall economy.

In alignment with the troubling truck tonnage index, the US Gross Domestic Product (GDP) has also experienced sluggish growth, with a mere 1.1% annualized increase in the first quarter of 2023. This figure falls short of economists’ expectations, who had anticipated at least a 2% growth following the previous quarter’s GDP climb to 2.6%. It is worth noting that, historically, the US has witnessed an average annual GDP growth rate of 3.13% from 1948 until 2023. However, post-pandemic slowdowns have compelled analysts to revise growth rate projections downward to a modest 2%. These recent reports may serve as ominous indicators of an impending economic recession 2023. As we move further into the summer months, it is imperative to closely monitor the trucking index, freight volumes, and GDP reports. These metrics will provide valuable insights into the economy’s health and crucial guidance for businesses and policymakers.

Diesel

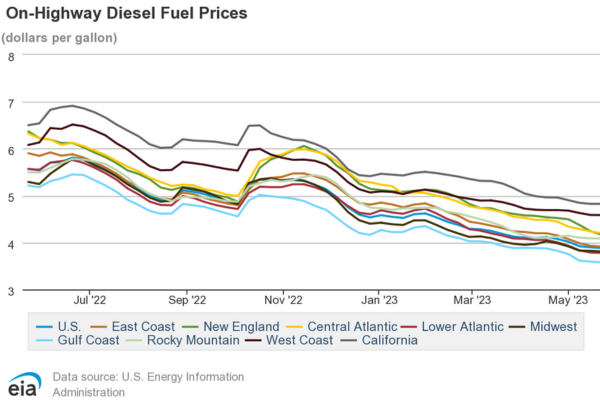

Great news for transportation purchasers: the national average price for on-highway diesel, according to the Department of Energy, has experienced a notable decline for the fifth consecutive week, now standing at $3.883 per gallon. This decrease represents an 18% drop since the beginning of the year. The combination of reduced diesel prices and a soft freight market brings relief to those procuring transportation services. Small to mid-sized carriers benefit the most from these lower prices, as they can reduce operating costs in this current environment. However, it is essential to approach this development with caution, as the decline in diesel prices is more likely a result of reduced global demand rather than increased supplies. A recent Barron article highlighted that Morgan Stanley revised its third-quarter price expectations for oil to $77.50 per barrel, down from $90.

Additionally, Marathon Petroleum noted that gasoline and jet fuel demand remained strong while diesel fuel demand remained sluggish. As a result, diesel fuel futures traded at a 52-week low. We will continue to monitor diesel fuel pricing and demand as we enter the summer months.

Cargo Fraud on the Rise

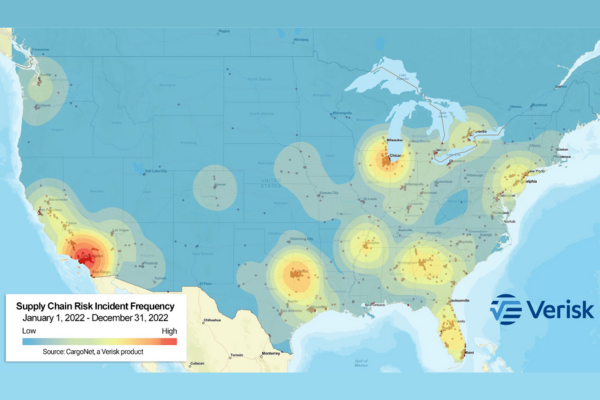

Cargo theft has become a pressing concern in 2023, with the frequency of incidents and the value of stolen goods experiencing double-digit increases. This troubling trend, as reported by CargoNet, shows no signs of abating as we progress through the year. Just five months into 2023, the total number of reported incidents has already surpassed the figures from the entire year of 2022, according to Keith Lewis, the Vice President of Operations at CargoNet. Several factors contribute to the surge in cargo theft activities, but two stand out. Firstly, the competitive market creates an environment where criminals seek illicit opportunities to gain an unfair advantage. Secondly, thieves have honed their skills in hacking digital supply chain systems that share valuable data, providing them with critical insights for planning and executing theft operations. A recent article by CNBC reveals that food and beverage products are particularly vulnerable, topping the list of targeted goods for cargo theft. The recent rise in food inflation could be a driving factor behind this increase. The Federal Bureau of Investigation (FBI) estimates that cargo theft costs the industry a staggering $15 to $30 billion annually.

Highly populated areas with access to ports, warehouses, and railyards become prime targets for criminals, making Los Angeles the most vulnerable and high-risk location. Cybercriminals are now posing as legitimate trucking companies to steal valuable loads. This highlights the pressing need for heightened vigilance among all stakeholders in the supply chain. Implementing measures to verify the authenticity of carriers arriving at facilities becomes crucial in preventing theft incidents. Recognizing the severity of the problem, the Transportation Intermediaries Association (TIA) has taken steps to combat fraud in the supply chain. Recently, they met with the Federal Motor Carrier Safety Administration (FMCSA) to discuss potential solutions and collaborative efforts. It is imperative for all industry participants to actively contribute to ensuring supply chain integrity by implementing robust security measures and staying updated on evolving threats.