Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our September 2023 issue: diesel prices, technology, and trucking updates. The Cold Front is a monthly summary highlighting pertinent cold chain storage market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

Diesel Prices: Up, Up, and Away

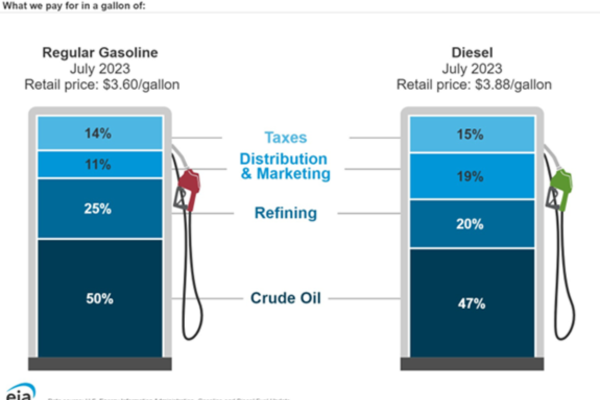

Since July, the Department of Energy’s national average price for diesel fuel has increased for nine consecutive weeks, an increase of 23%. The surge has the shipping community concerned, and there are no signs of relief anytime soon. A recent announcement from OPEC+, specifically Saudi Arabia, called for a cut in production due to low demand for 2023. The reduction in oil production will adversely affect supplies, causing high prices at the pump for the foreseeable future. The high cost of diesel and gasoline comes when prices fall after the busy summer travel season, making some noise in the trucking industry.

Additionally, as we enter the winter months, predicted colder than last year, some production shifts to home heating oil, creating more demand. Since tapping into the strategic petroleum reserves in 2021, an effort to combat the rising fuel prices, our strategic oil reserves have dropped from 640 million barrels to 350 million barrels, a significant decrease. We don’t see how the US can continue to use the strategic reserves to reduce the prices at the pump. Although the US is one of the largest oil producers in the world, producing close to 13 million barrels per day, it exports most of that oil to other countries. For a country that consumes about 20 million barrels per day, the current level of strategic reserves is concerning and something we will keep a close eye on now and in 2024.

Technology: Is help on the way?

On September 11, 2023, Utility Trailer Manufacturing partnered with European trailer manufacturer Schmitz Cargobull Corporation. The new company, Cargobull North America, unveiled new refrigeration units utilizing electric technology. This technology complies with California’s emission standards for 2030. The hybrid technology is touted to save 20% of fuel consumption for reefer trailers and also offers a fully electric version that will be available on some Utility models. How long the return on investment will take is still unclear; however, it is a step in the right direction to combat the rising fuel cost.

The current cold storage infrastructure should be considered as new technology becomes available. Retrofitting existing facilities and planning for new developments must be addressed. A lot of progress has been made in the electric recently. According to a recent study, Tesla’s Semi gives a chance to prove itself to naysayers, ” ‘[It could] revolutionize the freight transportation industry.” The Tesla Semi is stated to have a 500-mile range and can fast charge to run 800 miles in 24 hours. The extent of an electric semi versus one that runs on diesel is a big hurdle for the market. Additionally, running costs per mile and charging infrastructure must be addressed before the industry adopts an electric semi. We still feel we are several years away, but technology is rapidly progressing and improving.

Trucking Update: Authorized Carriers On The Rise

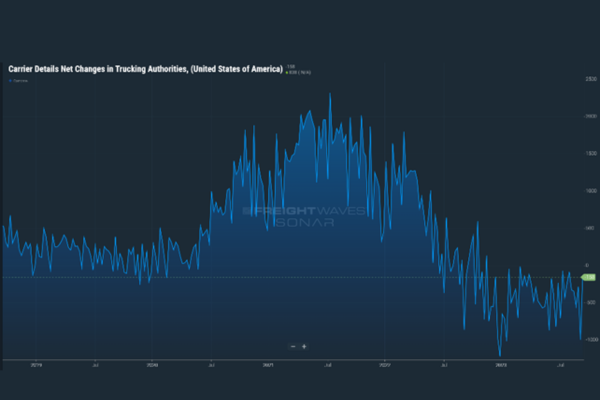

In June 2020, there were approximately 242,000 registered for-hire motor carriers in the market, according to DAT. Today, about 475,000 for-hire motor carriers are registered with the DOT. That is a significant increase, and although we have seen several high profile trucking failures this year, there are still more trucks in the market than freight to move. The question remains, but for how long? If you ask five industry experts, you may get five different answers. The truth is, nobody knows. Many factors influence the trucking sector. According to FreightWaves Sonar, the reefer outbound tender volume index is close to late 2018, a good year for trucking. But, with a 96% increase in active authorities, excess capacity remains a factor, and there is a lot of competition for freight. The American Trucking Association (ATA) reported a 0.2% increase in truck tonnage for August. We suspect that we will continue to see capacity exit the market as small carriers will feel the squeeze with the current cost of diesel fuel. Diesel fuel is the top expense for trucking companies, and the smaller carriers will be challenged to manage the higher operating costs.

Furthermore, higher interest rates on equipment will affect how smaller fleets add or replace equipment. We suspect we haven’t seen a more significant decline in trucking fleets thus far in 2023 due to robust earnings for trucking companies in the past few years. However, as small fleets burn through cash reserves, we expect a more balanced market in Q1-Q2 2024.