Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our October 2023 issue: warehouse leases, oil prices, and freight market conditions. The Cold Front is a monthly summary highlighting pertinent cold chain storage market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

Warehouse Leases

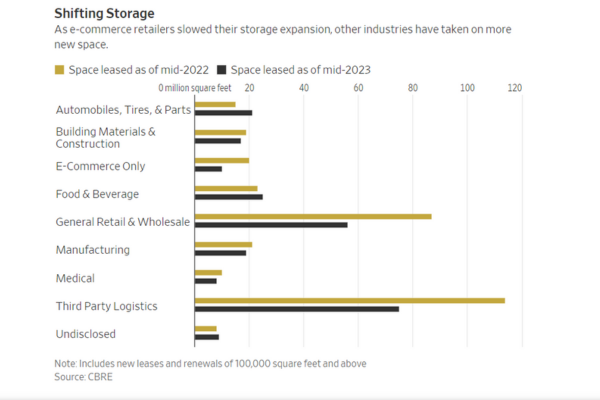

Although the industrial market has cooled off since the pandemic driven demand, the amount of available storage remains tight, according to CBRE, a leading commercial real estate firm. Logistics operators leased about 205 million square feet of warehouse space in Q2 2023, down from 235 million square feet the same time the prior year. The 205 million square feet is still significantly higher than the 135 million square feet in the second quarter of 2019. Rents remain high, and capacity remains tight despite slowing leasing and a 55% reduction in new construction from the previous year. Several factors can be attributed to the propped demand. The surge in e-commerce over the past few years has been one of the major drivers for industrial real estate demand and continues to be a factor today. Additionally, many companies have shifted their supply chain models to a near shoring strategy, driving demand in the US and Mexico. Also, companies focus more on supply chain resiliency, shifting shipments and inventories from West Coast ports to the East Coast. So, although commercial real estate demand is cooling off, it is still strong enough to command high rents as capacity remains tight.

Oil Prices

The World Bank recently warned that the price per barrel of oil could soar to $150 per barrel should the conflict in the Middle East reach a “large disruption” scenario. In a recent announcement, The World Bank outlined three possible scenarios for oil prices. A ‘small disruption’ could bring the cost per barrel to $93-$102; a ‘medium disruption’ could get prices to $109-$121 per barrel; and a ‘large disruption’ would soar to a record high of $147-$157 per barrel. It should be noted that The World Bank has forecasted oil prices at $90 per barrel for the balance of 2023 before declining to $81 per barrel next year as the global economy slows. The World Bank cited the disruptive effect of the war between Russia and Ukraine and the escalating conflict in the Middle East, which could cause a dual energy shock, resulting in a rise in oil prices and food inflation. These are dire times, and we will continue to monitor oil prices and inflation.

Freight Market Conditions

In previous editions of The Cold Front, we have discussed the weak freight market and weighed in on when we could start to see it turn around. There are many opinions on when the freight market will turn around. For trucking companies, it can’t come soon enough. However, experts now predict conditions could last until 2025, as analysts predict a slow growing GDP into 2024. Consumer spending continues to be at the forefront. The Federal Reserve increased interest rates by 2% points in 2023, reducing consumer spending.

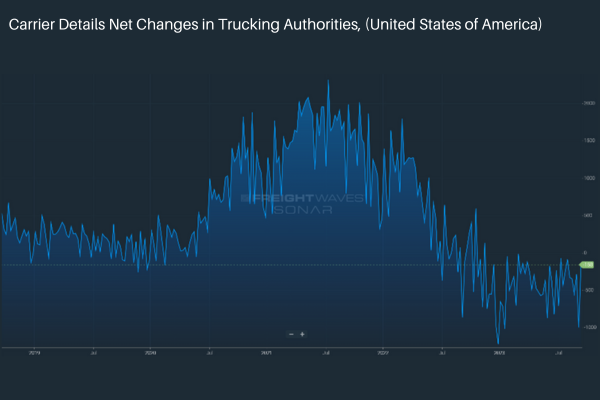

Additionally, retail inventories remain high, weakening demand. Although there has been a contraction in changes in net trucking authorities, as reported in Freightwaves Sonar, there is still overcapacity in the marketplace. We anticipate that capacity will continue to correct with more motor carriers unable to sustain; however, the timeline is still a wild card. Overall, outbound tender volume is growing, albeit at a slow pace. Typically, the 4th quarter volume surge propels the industry into the following year. We must watch outbound freight volumes and carrier revocations to understand the impact. We suspect the holiday surge will not be as strong as in previous years. The American Trucking Association’s truck tonnage index for September 2023 saw a 4.1% decline compared to a year ago. The recent decline was the most significant drop since November 2022, signaling that the market is still very volatile.