Cold Front Preview

Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage, and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our January 2024 issue: industrial capacity, global trade disruptions, and truck tonnage trailer orders. The Cold Front is a monthly summary highlighting pertinent cold chain storage market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

Industrial Capacity

In a recent article published in The Wall Street Journal, according to a report from Cushman & Wakefield, there is more warehouse capacity than any other time post pandemic. The average warehouse vacancy rate rose to 5.2%, up from 4.6% in the previous quarter and 3.1% in the prior year. Although the vacancy increase has set off alarms for developers who have pulled back on some projects, the vacancy rate is still lower than pre pandemic figures. According to Cushman & Wakefield, the 15 year vacancy rate average is 6.4%. So, although we may witness slower construction based on this demand, the industrial real estate market is still relatively strong.

Demand for space has been strong in many major industrial areas, and the average rent for industrial space increased 10% in the fourth quarter year over year. It is important to note that the above figures include all commodities and are not specific to an industry. However, according to a recent article published by Refrigerated and Frozen Foods Magazine, the demand for cold storage is expected to outpace supply over the next three to five years. Once unheard of, over 3.3 million square feet of speculative cold storage is currently in development. Significantly higher than just 300,000 in 2019. The cold storage industry is also witnessing an increase in investors looking to capitalize on the expected growth. According to CBRE’s 2022 US Investors Intention Survey, nearly 40% of respondents pursued cold storage assets in 2023, up from 22% in 2021 and only 7% in 2019. The future still looks bright for cold storage operators, although current demand has subsided.

Turmoil on the High Seas

Approximately 12% of all global trade passes through the Suez Canal in the Red Sea. The canal is a critical waterway and shortcut for trade between Europe and Asia, accommodating around 19,000 ships annually. The canal is vital for oil and natural gas transportation, handling 10% of global oil and 8% of natural gas shipments. Recently, getting to the canal has been risky, as attacks near the Bab al-Mandab Strait have become aggressively more prevalent. As a result, container rates from Shanghai to Europe increased by 8.1% in just over a week.

Also, container rates to the US west coast have increased by 43.2%, according to a recent Reuters article. The ocean shipping industry is sounding the alarm for higher shipping costs that could be here for the long run. Several major container lines, like Maersk and Hapag-Llyod have rerouted ships from the Red Sea route and around Africa’s Cape of Good Hope. The ripple effect is disrupting schedules and increasing global shipping costs.

To put it into perspective, experts estimate that rerouting ships adds ten days and $1 million in additional fuel costs between Asia and Europe. Experts warn that even if the straight is declared safe and secure, it will take months to reposition ships to the route. What is happening in the Red Sea underscores the complex and volatile supply chain and highlights the significance of maritime routes to global trade. As we all should, keeping a close eye on what is happening in this part of the world is imperative for global trade and stability.

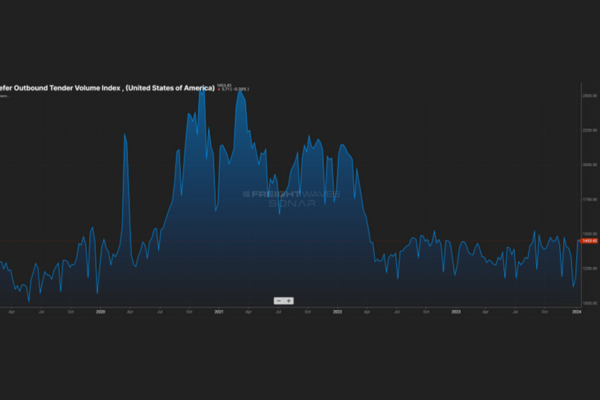

Truck Tonnage-Trailer Orders

The American Truck Association’s (ATA) seasonally adjusted for hire truck tonnage index decreased by 1% in November 2023. ATA Chief Economist Bob Costello stated, “It seems like every time freight improves, it takes a step back the following month…the freight market remains in a recession.” Similarly, in a recent Freightwaves article, trailer orders plummeted 38% in November from the previous month.

Additionally, diesel fuel prices have declined since October, signaling weak demand. It is no secret that we are in a freight recession; the question of how much longer remains. The freight recession began in early 2022, and there has been a lot of chatter on when we will exit the tough market, but it has shown little improvement since, making predictions difficult and futile. In a recent article published by Freightwaves, the end of the freight recession could be on the horizon. This prediction was in response to an inventory replenishment strategy that would push freight volumes higher. Morgan Stanley predicts it could happen at the end of this year’s first quarter. As shippers continue to right size inventories, and consumer spending remains healthy, it could create a restocking event. As illustrated above, the vacancy numbers signal shipper destocking, which is not sustainable in the long term. We will continue to monitor tonnage and inventory as we move into 2024.

Connect with the Cold Chain Experts this Spring

The RLS business development team will exhibit at various trade organization events this upcoming season. See one you are also attending and want to connect? Contact us to set up a meeting time!