Cold Front Preview

Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage, and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our February 2024 issue: food inflation, a Red Sea shipping crisis update, and a transportation market update. The Cold Front is a monthly summary highlighting pertinent cold chain storage market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

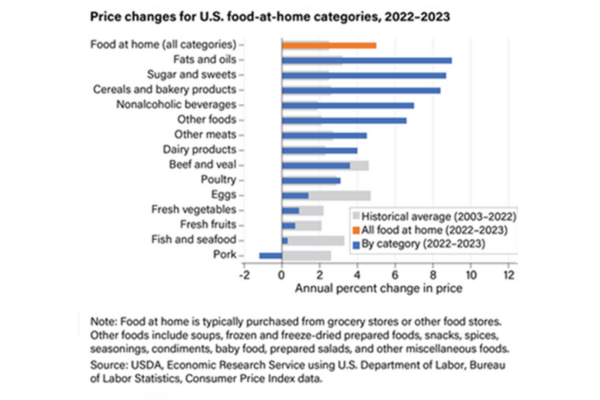

Food Inflation

The January 2024 consumer price index report released on February 13th reported a 0.3% increase in January, slightly above the 0.2% increase in December. The market received the increase as expected, and the overall narrative is that inflation is under control and will revert in line with the Federal Reserve’s 2% target remains in question. Food inflation is divided into two categories: food at home and food away from home. The food index saw an increase of 0.4%, with food at home coming in at 0.4% and food away from home at 0.5%. Americans are still seeing the pinch of higher food costs at the grocery store, and going out to eat seems to be a luxury these days. To put it into perspective, from 2019 to 2023, food inflation increased by a staggering 25% and 5% since 2022. According to the USDA Economic Research Services report, the categories that led food inflation for 2023 were Fats & Oils +9%, Sugar & Sweets +8.7%, and Cereals & Bakery items +8.4%. Pork was the only category that saw a decline in price in 2023,-1.2%. The price of eating out has increased by +5.1% year over year, far exceeding the additional costs of eating at home. Food inflation doesn’t appear to be subsiding anytime soon.

Update on Red Sea Shipping Crisis

It has been a few months since ocean containers began seeing hostilities in the Red Sea. In that time, shipping lines have had to reroute freight to avoid the danger, resulting in additional costs to operate and ensure vessels and their cargo, and the hostility is increasing. According to the U.S. military, an unmanned underwater vessel in the Red Sea was destroyed. It was the first time this type of vessel was observed since October, when the attacks began. In a recent article by CNBC, it was reported that the Containerized Freight Index (CFD) had increased by 23% since January and was expected to climb from 406.75 basis points to 2302 by the end of the first quarter, an increase of a staggering 565%.

The increased costs are expected to impact inflation but should not be significant. The disruptions go beyond the obvious economic impacts; shipping companies are bullish on consumer demand, which has witnessed steady growth over the past year. Experts warn that the diversion of traditional freight routes may cascade in equipment availability at essential ports, further exasperating the financial impact. We will keep an eye on shipping rates over the coming months as we enter what could be a busy and volatile year for ocean rates.

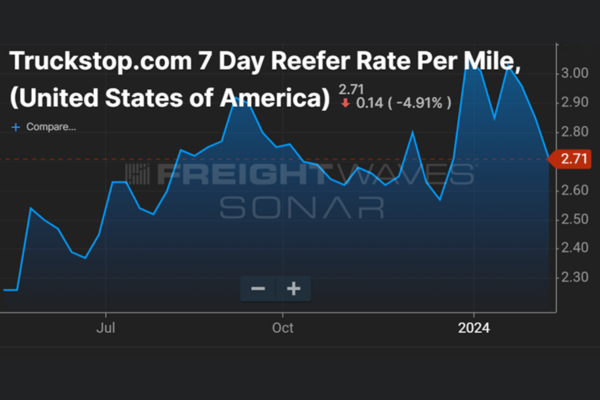

Transportation Market Update

The one certainty regarding the transportation market has been uncertainty. Earlier this month, the Wall Street Journal published an article citing a market rebound taking shape. However, the ATA’s January truck tonnage report was just released, citing a sizeable decrease of 3.5% from December. Hence keeping the debate about when the trucking market will turn the corner.

There are signs of improvement, nonetheless. The Logistics Manager Index showed an increase of 0.9 basis points compared to one year ago. Capacity continues to exit the market; approximately 88,000 trucking authorities were revoked last year, and 8,000 transportation brokers shut their doors. Additionally, transportation rates have seen a slight uptick, and the United States added approximately 350,000 new jobs in January. Diesel fuel prices have been holding steady, and many areas have witnessed a decrease in the load-to-truck ratio. So, the economy seems to be headed in the right direction, and analysts expect a string of interest rate reductions in 2024. However, if a turnaround is in the future, it may take its sweet old time to reveal fully. The question remains: WHEN?

Connect with the Cold Chain Experts this Spring

The RLS business development team will exhibit at various trade organization events this upcoming season. See one you are also attending and want to connect? Contact us to set up a meeting time!