Cold Front Preview

Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage, and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our April 2024 issue: Food Inflation, Truck Tonnage, and US Imports. The Cold Front is a monthly summary highlighting pertinent cold chain storage market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

Food Inflation

Although overall inflation is cooling, food inflation is still a hot topic, not only here in America. In April, the average price of food in the U.S. rose by 2.2%. Although the rate of increase has slowed significantly since its peak in mid-2022 of 11.4%, it is still causing pain for consumers at the checkout line. Supermarket prices are now 25% higher than in January 2020, while inflation has increased 19% in the same period. Although grocery costs are increasing, albeit slower than during the pandemic, consumer confidence in the overall economy has declined after a three-month increase.

In a recent Yahoo Finance poll, two-thirds of respondents cited that food prices had the most impact on inflation, followed by fuel and rent prices. Although it is difficult to pinpoint why food prices remain high, some speculate that manufacturing labor costs have increased dramatically since the pandemic. Wage increases were necessary for retaining and attracting essential employees, and it is almost impossible to roll back. According to a recent article by CBS News, certain foods have been responsible for 30% of food inflation. Those foods are beef, veal, poultry, nonfrozen and noncarbonated juice, fresh fruits, vegetables, and snacks. I don’t know about you, but those foods make their way into my carriage on just about every shopping trip.

The article also cited the rise in prices at our favorite fast-food chains, citing a 5.8% increase in January from just one year ago. The rising food prices don’t hit us all equally. Those who earn less are hurt the worst. As a percentage, lower-income earners sometimes spend up to 25% more of their money on groceries. Experts predict that prices at the grocery store should moderate throughout the year, although restaurant meals are expected to end up at almost 5%. We will monitor the economy and consumer confidence as we head into grilling season.

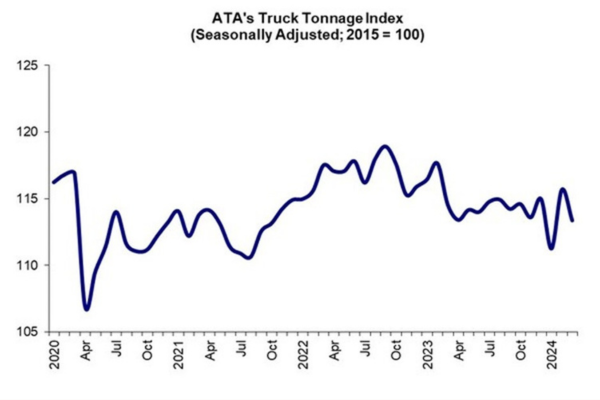

Truck Tonnage

The American Trucking Association’s seasonally adjusted for hire truck tonnage index decreased 2% in March. The decrease took the wind out of the freight sales after reporting a 4% increase in February. The ATA’s Chief Economist, Bob Costello, said, “Tonnage in March suggests that truck freight volumes remain lackluster, and it is clear that the truck recession continued through the first quarter.” Costello went on to say, “In the first three months of 2024, ATA’s tonnage index contracted 0.8% from the previous quarter and declined 2.4% from a year earlier, highlighting ongoing challenges the industry is navigating.”

We have stated in several previous editions of The Cold Front that predicting when this freight recession will end is difficult to predict, and at this point, it is all guesswork. Although there has been some exiting of capacity, there remains an oversupply of trucks to freight in the marketplace. The current freight recession has Wall Street chattering as first-quarter earnings reports began coming out on the publicly traded companies. Wall Street has lowered earnings outlooks for most publicly traded trucking firms. The brief uptick in rates earlier in the year may have offered some hope to carriers clinging to using those additional earnings collected during the pandemic. Most analysts agree that we have hit the floor regarding rates but are surprised at how long we have been bumping the bottom. There is a glimmer of hope on the horizon; traditionally, election years have resulted in higher consumer confidence, a welcome sign for later this year.

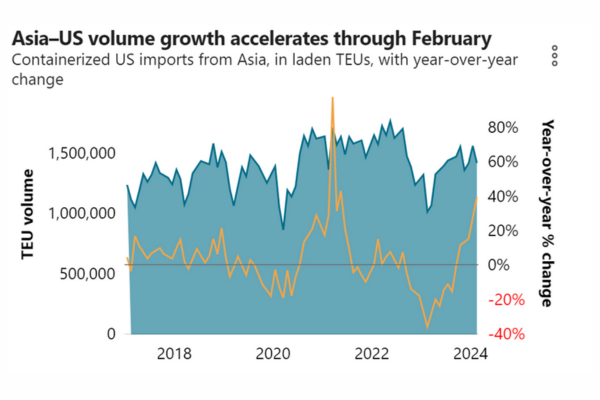

US Imports

A bright spot in the troubled freight recession could be found in a recent article by the Journal of Commerce that reported that US import container volumes were up by double digit percentage points over this period last year. The import volume was cited as broad enough to suggest that inventory restocking is underway, which could bolster warehouse capacity and inland trucking services. United States retailers upgraded import expectations for the third straight month by 11%. The Port of Los Angeles reported that their import volumes were up 30% in the first quarter, the third best quarter in history.

The port’s Executive Director, Gene Seroka, was quoted earlier this month, “The demand starts with the US consumer, and all of those statistics look very strong.” According to Jason Miller, a transportation economist, the types of imports are important. The top five product categories leading containerized imports reported by the US Census Bureau data are semiconductors, plastic products, household furniture, motor vehicle parts, and household appliances. These commodities signal a strong U.S. housing market, up over 20% from last year. US imports from Asia in February were 1.42 million TEUs, up almost 40% from February 2023. This news could signify an overdue recovery from the over two year freight recession.

Connect with the Cold Chain Experts this Spring

The RLS business development team will exhibit at various trade organization events this upcoming season. See one you are also attending and want to connect? Contact us to set up a meeting time!