Cold Front Preview

Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage, and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our March 2024 issue: East Coast port labor, Ocean Shipping Reform Act, and an economic update. The Cold Front is a monthly summary highlighting pertinent cold chain storage market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

East Coast Port Labor

Almost a year ago, in June 2023, an agreement was finally reached between the Pacific Maritime Association and the International Longshore and Warehouse Union, which concluded work stoppages and labor slowdowns at West Coast port operations. The agreement came at a pivotal time and on the tail of the supply chain disruptions and the fragile global supply chain during the pandemic.

At that time, the labor union had a strong position; the previous year saw record imports of goods from Asia, which created a backlog of many container ships waiting to berth off the West coast of the United States. During that time, importers and US retailers took drastic measures to ensure their goods made it into the supply chain. Some chartered their ships to meet demand, while others diverted containers to the East Coast, where ports were less congested, creating a windfall and even lasting new business. Well, here we are one year later, and port labor and a possible work stoppage are back in the news, but this time, on the East Coast.

The International Longshoremen’s Association’s six year contract with the Maritime Alliance, which represents port terminal operators and ocean carriers on the East Coast and Gulf ports is set to expire on September 31st, right at peak fourth quarter season push. The current drought and restrictions at the Panama Canal are not helping matters. The East Coast, historically less likely to strike than their West Coast counterparts, is experiencing its own rerouting challenges as logistics managers divert shipments back to the West Coast. May 17th is a key date the union sets for local contracts to be agreed upon so the master contract can be negotiated by September 31st. It was in 1977 that we witnessed the last time the ILA stopped work. That strike lasted 44 days. According to a March 7th article on CNBC, the ILA is targeting increases larger than the 32% that was negotiated by the ILWU, their West Coast brethren. The last thing the East Coast ports need is to give back their gains by holding onto volumes diverted from the West Coast the past few years. We will continue to monitor the labor situation at the ports.

Ocean Shipping Reform Act: FMC Ruling

In other port news, the Federal Maritime Commission has issued a final ruling to simplify international container billing practices on detention and demurrage for truckers caught in the middle. The ruling does not eliminate detention and demurrage at the ports but redirects them to the responsible parties. Demurrage charges are fines imposed by ocean maritime companies for containers that sit on the docks at ports beyond their allocated free time. Detention charges are fees after the free time has lapsed and the containers are no longer on the docks. These charges can snowball quickly for shippers and importers at busy ports. It has always been the responsibility of the motor carriers contracted to deliver the containers that seek reimbursement from the shipper.

In a recent article in Transport Topics, the ruling takes effect on May 28th and will significantly benefit motor carriers who have been subject to scrutiny and finger pointing on who the responsible party is. It was the motor carrier’s responsibility to pay those charges upfront in hopes of being reimbursed by the shipper at a later date. After May 28th, ocean carriers must submit an invoice to the importer/shipping party within 30 days, ultimately removing the motor carrier from the transaction. The ruling does not absolve the carrier but clearly directs who gets the bill. This is a step in the right direction for accountability. Perhaps a case can be made by unloading/lumper charges that carriers must pay before the service is performed. One could argue that a transaction is between the party selling the goods and the party purchasing the goods, not the one delivering the goods. I doubt we will see a ruling there anytime soon, but it does make you wonder.

Economic Update

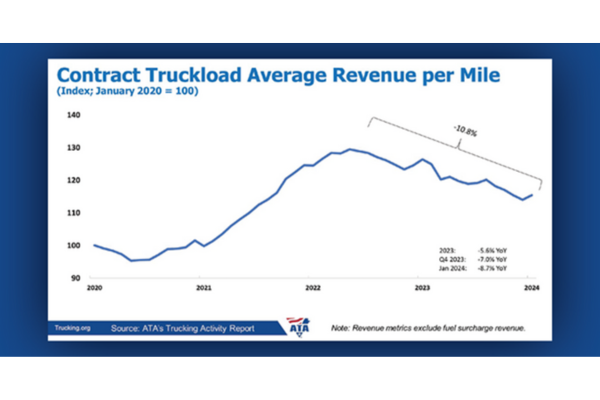

We recently had the pleasure of joining industry peers at the annual Food Shippers Conference held in Orlando, FL, earlier this month. One of the conference highlights is sitting through the Economic Update presented by Bob Costello, Chief Economist for the American Trucking Association. If anyone has heard Bob talk, you understand the relevance and great content he presents. As usual, it was a packed house as those in attendance listened carefully for any signal that would reveal when this trucking recession would end. Unfortunately, even Bob doesn’t know exactly when but he felt strongly that it is only a matter of time that it does. It was also clear that we are now at the bottom and can only go up from here. As always, Bob did a fantastic job delivering the presentation. We would like to highlight a few things that were discussed.

First, trucking has always been considered a bellwether for the overall economy and ahead of the curve for what is to come. Post pandemic spending for the US population has been primarily strong in terms of experiences, and not necessarily goods. During the pandemic, the spending was all on goods. Now that we are somewhat ‘back to normal,’ consumers have put experiences back on the top of the list, going back on vacations, events, and, yes, even trade shows.

As a result, 2023 witnessed lower spending on goods. That is anticipated to reverse this year and rise to more normal levels. The additional spending on goods rather than experiences should create more demand for trucking in 2024. Couple an increase in spending on goods with the continued failures of truckers exiting the market; the turnaround could happen sooner in 2024 than others predict won’t occur until early 2025. There are still many factors at play, but one thing is certain: given today’s pressure on freight rates, truckers’ savings stockpile during the robust market in 2020-2021 is depleting, causing many to cease operations. You can read more about this topic and other topics covered at the conference by visiting the Food Shippers of America website here.

Connect with the Cold Chain Experts this Spring

The RLS business development team will exhibit at various trade organization events this upcoming season. See one you are also attending and want to connect? Contact us to set up a meeting time!