Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage, and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our June 2024 issue: Ocean Shipping & East Coast Ports, Domestic Transportation, and Cold Storage Warehousing. The Cold Front is a monthly summary highlighting pertinent cold chain storage market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

Ocean Shipping & East Coast Port Update

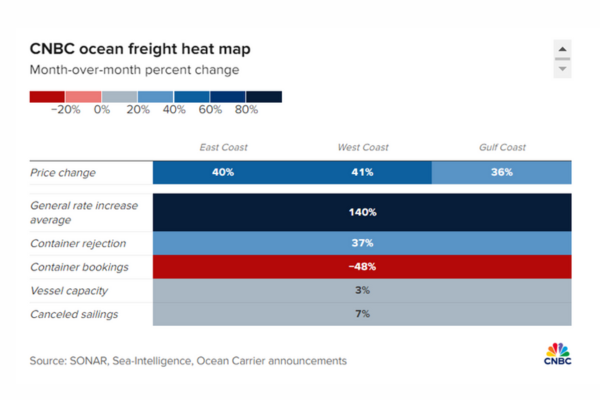

The global supply chain is experiencing significant trade inflation as container shipping rates have soared to a concerning level not seen since the pandemic. According to a recent article by CNBC, spot ocean rates from Asia to the US have seen a 40% increase month over month. Ocean carriers have implemented a general rate increase of approximately 140%. Experts cite the main reason for the increase in the turmoil surrounding the Red Sea. Container traffic through the Red Sea has decreased by about 90%, and the alternative shipping routes around Africa are adding 11,000+ miles on the voyage. The spike in rates has shippers baffled and frustrated. According to the data, container bookings are down 48%, and vessel capacity is up 3%. It makes you wonder if the maritime industry has figured out how to control supply and demand, as the domestic transportation markets still lag and remain soft for the past two years. Ocean carriers are canceling vessel sailings, setting up tighter capacity for the overall market.

In related news, there is concern that an East and Gulf port strike could impact rates on the West Coast. The International Longshoreman’s Association (ILA), which represents union works at the East and Gulf ports, and the United States Maritime Alliance (USMX), which represents the ports, have suspended contract talks, igniting fears of port strikes. Savvy shippers have moved up sailings to support Q4 holiday activity in anticipation or are diverting entry ports to the West Coast in an effort to reduce the impact. ILA President Harold Daggett warned, “The threat of a coast wide strike on October 1, 2024, is becoming more likely as USMX and its member companies continue to drag their feet.” This is not the news that the East Coast Port and service providers want to hear. United States manufacturers, distributors, and retailers are calling on the current administration in Washington to intercede and restart contract negotiations.

On a positive note, the South Carolina Ports Authority and the ILA have recently settled a dispute that kept the port offline since 2021. The deal effectively increases container traffic to Charleston by over 30% and is being touted as a long-term win for the Port of Charleston. Hopefully, that could be the catalyst for opening up the negotiations between USMX and ILA. We will continue to watch and report on this developing story.

Domestic Transportation Update

As the maritime industry figures out how to control capacity to increase ocean rates, the story differs for US domestic transportation. In a recent Transport Topics article, Dean Croke, principal analyst at DAT Freight & Analytics, stated, “We’ve seen slowing carriers leaving the industry, but we have seen an increase in the number of carriers joining the industry.” That statement leaves many of us scratching our heads. The fact that new entrants are emerging in this unhealthy market is puzzling.

According to DAT, the total number of carriers in the market in Q1 dropped 12%, which was met with a 20% increase in new carriers entering the market during that period. Experts believe many carriers are holding on by a thread in anticipation of a market correction. However, when that will happen is anybody’s guess. According to a recent report by ACT Research, recovery may not be too far off. Even with soft trucking demand, global shipping disruptions and inventory replenishment will add much-needed demand for a market correction. We believe this to be true. However, we are witnessing a challenging manufacturing marketplace where inflationary production costs remain high. Reuters reported a slowdown in manufacturing and services in April, with activity at a five-month low. The Federal Reserve has been watching a string of stronger-than-expected inflation and employment numbers, which indicates the fight to bring inflation back down to 2% could have stalled or even reversed. If the new data shows anything, no one can predict when the market conditions for domestic transportation will turn. However, one thing is sure: they will turn.

Cold Storage Warehousing

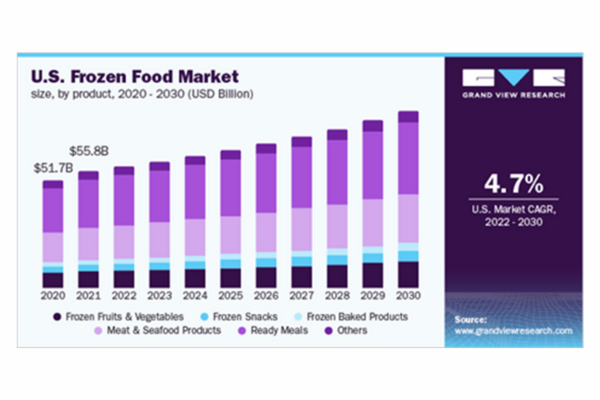

Despite tough shipping market conditions and a shift from just in case to just in time, cold storage warehousing is still in demand, and our internal available capacity has been close to zero for a few years now. However, according to the most recent USDA cold storage report, red meat and poultry stocks are down from those one year ago. According to the report, red meat was down 12%, pork was down 13%, veal was down 66%, and poultry was down 5%. However, Americans are still eager for frozen and nutritious meals, and manufacturers are doing a good job messaging the perception that frozen foods are less healthy than fresh foods.

According to a market report by AFFI, although frozen foods grew at an 8% compound annual growth rate, it is expected to retreat to a modest 4.4% over the next four years. The concern for the industry is whether cold storage warehousing can keep up. We see a strong cold storage climate over the next few years. We will continue to provide you with key insights into cold storage warehousing, even if our internal data contradicts the external data.