Frozen and Refrigerated Cold Chain Insights

Welcome to The Cold Front, presented by RLS Logistics, the Cold Chain Experts! We proudly offer nationwide cold storage warehousing, ltl shipping, truckload freight brokerage, and eCommerce fulfillment cold chain solutions. This month’s edition focuses on these topics for our August 2024 issue: Labor Supply Chain Disruptions, Direct to Consumer Grocery Market, Peak Season. The Cold Front is a monthly summary highlighting pertinent cold chain storage market data in one concise location. These insights ensure that you have the data to make better decisions to fuel your growth. We hope you find this information useful! If you want data on your specific market, click the button below.

Labor in the Supply Chain: Disruptions

Global supply chain professionals can breathe a sigh of relief for now. If you hadn’t heard, the Canadian rail workers were at a standstill with Canadian National Railway and Canadian Pacific Kansas City as of August 21st and were set to strike. The union representing approximately 10,000 rail workers disputed work-life balance issues with the railroads, which extended shifts from 10 hours to 12 and reduced rest periods from 24 hours to 12. A lockout would have had a significant economic impact on Canadian exports and US imports.

However, a decision by the Canada Industrial Relations Board has imposed binding arbitration, which forces the union back to work and sets a precedence for other federally regulated companies, particularly for the airline industry, which has been discussing a new contract for its pilots. The decision was met with opposition from the union and hailed by the railroad operators, citing the country’s economic health as its top priority. In another close call, 20,000 Indian port workers called off an indefinite strike on Tuesday after agreeing to a five-year new contract increasing wages by 8.5% over the next five years. This agreement avoided further issues in an already frail global supply chain. In related news, East and Gulf Coast port unions are calling on a federal mediator to get a contract done before the October deadline to avert a strike. A port strike along the East and Gulf Coast in the 4th quarter will significantly impact the global supply chain and could be why we are witnessing increased import activity as companies prepare for the worst. These three events highlight the importance of labor in the global economy. We will continue to monitor talks and hope mediation is successful.

Direct to Consumer Grocery Market Update

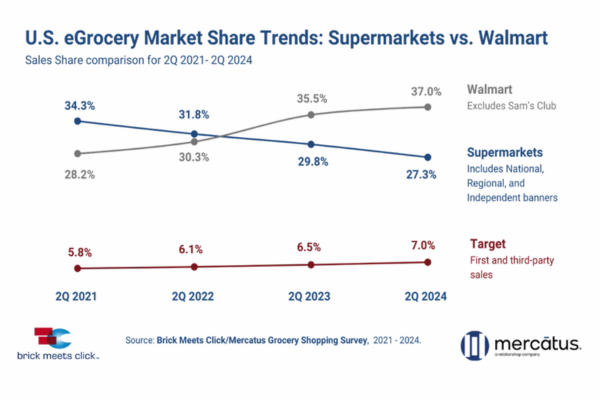

According to a recent report by Brick Meets Click and Mercatus, Walmart’s share of the grocery e-commerce increased to 37% while grocers continue to lose online sales share. Online grocery sales reached $7.9 billion in July, an increase of more than 9% compared with July last year. The report cited a sharp discount in Walmart membership fees, catapulting online sales revenue to the top spot. Additionally, Target continued to gain market share in e-commerce grocery sales. Walmart’s focus on the customer experience, a mobile app, and drone delivery expansion has catapulted the world’s largest retailer into the number one spot for online grocery shopping. The company has achieved over 30,000 drone deliveries thus far in the Dallas, Fort Worth area, offering same-day delivery to 75% of the population. Their InHome experience is also available as an add-on to the Walmart+ membership.

With the use of AI, the app predicts replenishment and automatically places items in the cart for delivery straight to the kitchen or pantry. These innovations propel Walmart to the top of the chart for online grocery, while smaller regional grocers continue to lag behind a growing sector. In-store or curbside pick up continues to lead in total sales, but remains flat year over year, while ship-to-home and delivery continue to grow. Walmart is number 2, only behind Amazon on the Top 1000 Digital Commerce 360 list. In another move, the retailer has announced plans to expand its fulfillment and logistics prowess to include third-party sellers and other merchants. Expanding outside its marketplace positions Walmart to compete against Amazon’s logistics offerings and create a competitive advantage for other retailers.

Peak Season- What’s in Store

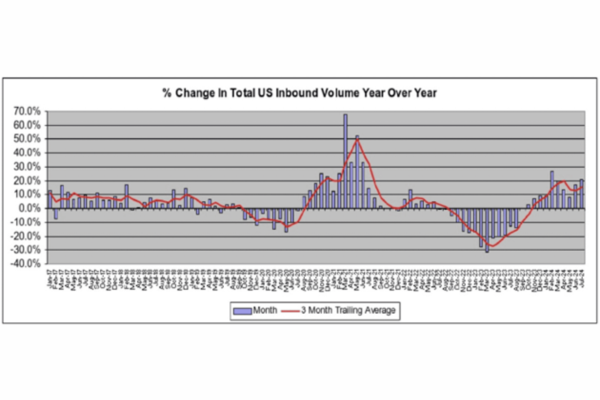

As we enter peak shipping season, questions about how the economy, inflation, and politics will affect traditionally the busiest time of the year. The stock market saw a significant one-day decline and set a new all-time high, all within the past several. The Federal Reserve has declared that the time has come to lower interest rates. Couple these with an election year, and you have a recipe for a potential spicy Q4. According to a recent McCown report, July witnessed a 20.9% increase in inbound container volume. The July increase was more significant than in June, which saw a 17.2% increase. These two months may be a leading indicator of an uptick in transportation volume in Q4 and continue to drive warehouse vacancies down.

Over the past few years, plenty of discussions have been made about when the freight recession might end and when the balance of power will shift back to the carrier. We have become numb to the noise, and instead of jumping to conclusions, we focus on internal data. Signs are pointing to some recovery. The cost of purchased transportation continues to rise, squeezing the margin. Additionally, we are witnessing a slight increase in LTL order and pallet volume, indicating mode conversion. Although it is too early to predict, it appears that the light at the end of the tunnel is no longer the train about to run us over, but it’s the other side. We will continue to monitor market conditions and our internal metrics to report how we see the conditions with boots on the ground. Either way, in an election year, Q4 should be eventful.

Read Past Issues of The Cold Front: